By: Palisade Research

http://palisade-research.com/1-of-our-favorite-stocks-for-the-palladium-bull-market/

The price of palladium rose above platinum prices.

But this shouldn’t come as a surprise. . .

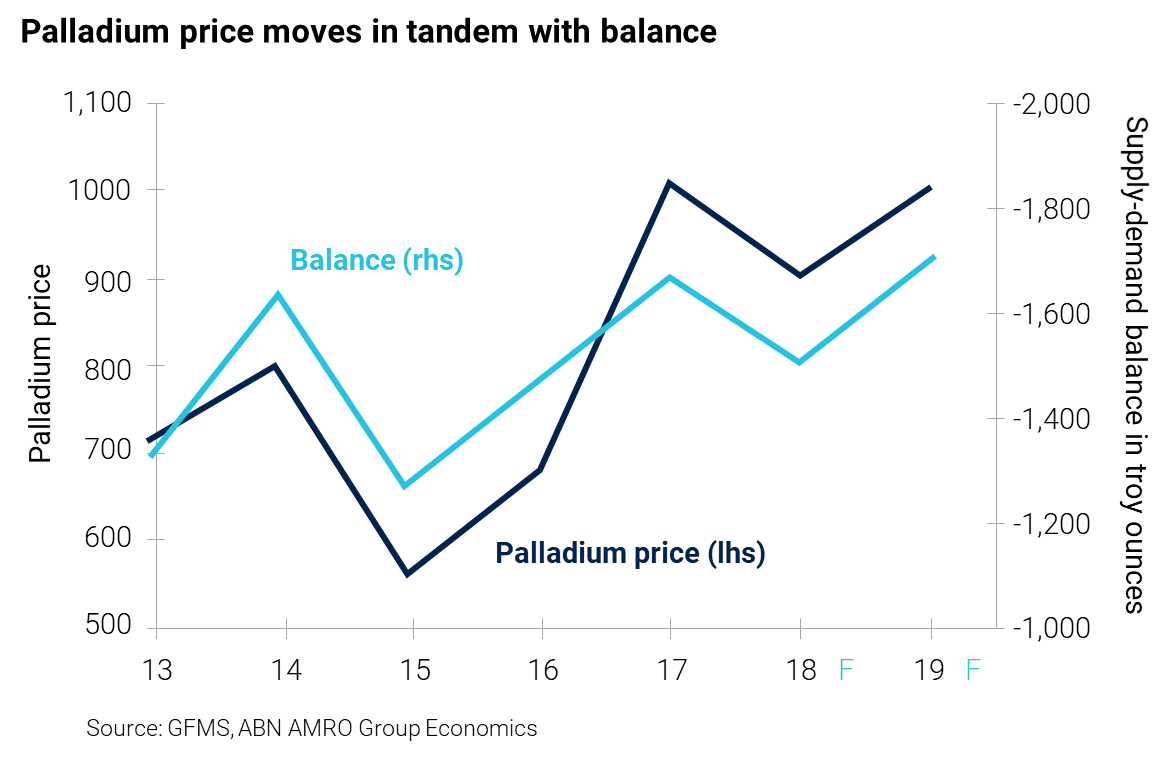

Palladium supplies have been running huge deficits.

There simply isn’t enough of the metal being supplied compared to what’s being used.

And it is only going to get worse for the next few years. . .

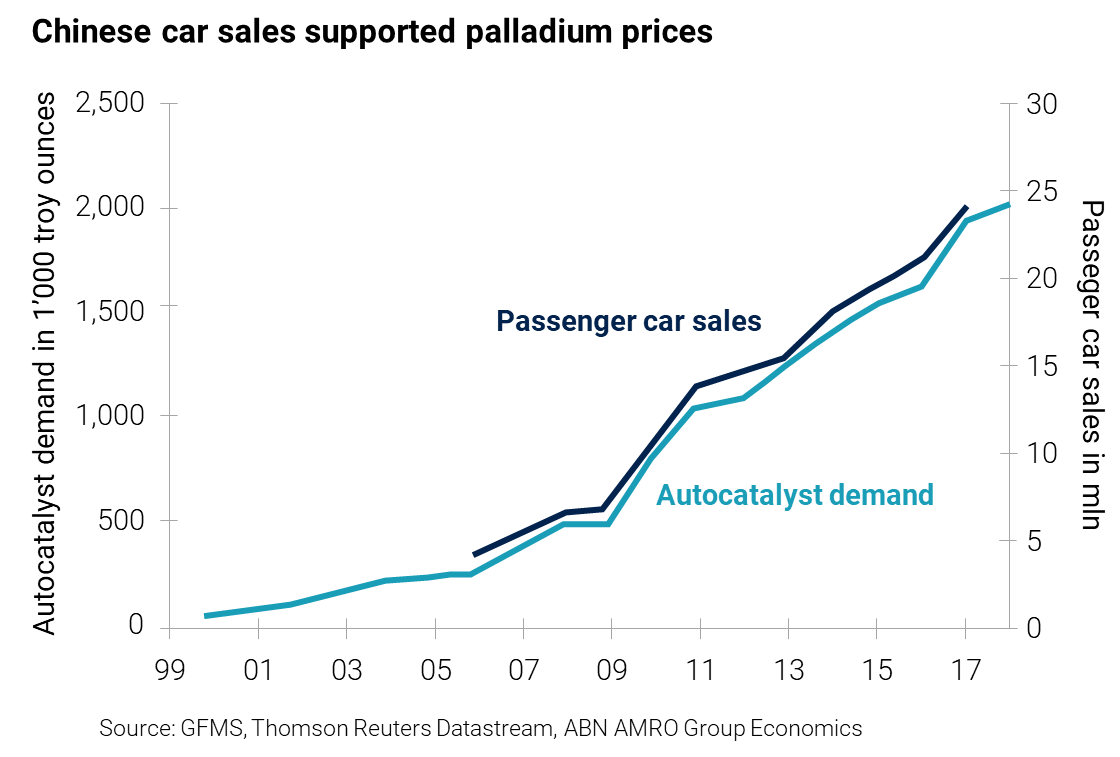

Palladium is mainly used in autocatalyst for vehicles.

“An autocatalyst is a cylinder or elliptical cross section made from ceramic or metal formed into a fine honeycomb and coated with a solution of chemicals and a combination of platinum, rhodium and/or palladium. It is mounted inside a stainless steel canister (the whole assembly is called a catalytic converter) and installed in a vehicle’s exhaust line where it converts pollutants from the combustion of fuel into harmless gases. “

You know how every couple of years you have to take your car and go sit in that line and pay $15 dollars to get your emissions checked before you can renew your vehicle’s registration?

Basically, without the palladium, vehicles would emit dirty emissions from the exhaust pipe and pollute the air.

Governments take this very seriously – especially in the U.S., Canada, and Europe. . .

But right now, China is the elephant in the room. . .

Why?

Because the crazy air pollution problem in China is making their citizens demand higher vehicle standards.

“People living in northern China will die at least three years earlier than their southern neighbors, according to a study published in the Proceedings of the National Academy of Sciences. . . In some cities, that number is closer to seven years earlier – wrote USA Today.”

That’s why the Chinese government has made it clear they will fight this pollution issue.

And that means higher emission standards for vehicles.

Which means. . .

You guessed it – more palladium being used. . .

This is the kind climate we want for a commodity. . .

A metal that is crucial to consumer markets and can’t be replaced, but needs higher prices to bring on new supplies.

And that’s why we put our money in this small company. . .

New Age Metals Inc. (CVE:NAM, OTCMKTS:PAWEF) – Working to be Canada’s Next Top PGM Producer

This micro-cap stock is a newer addition to our portfolio.

But it is one we are excited about. . .

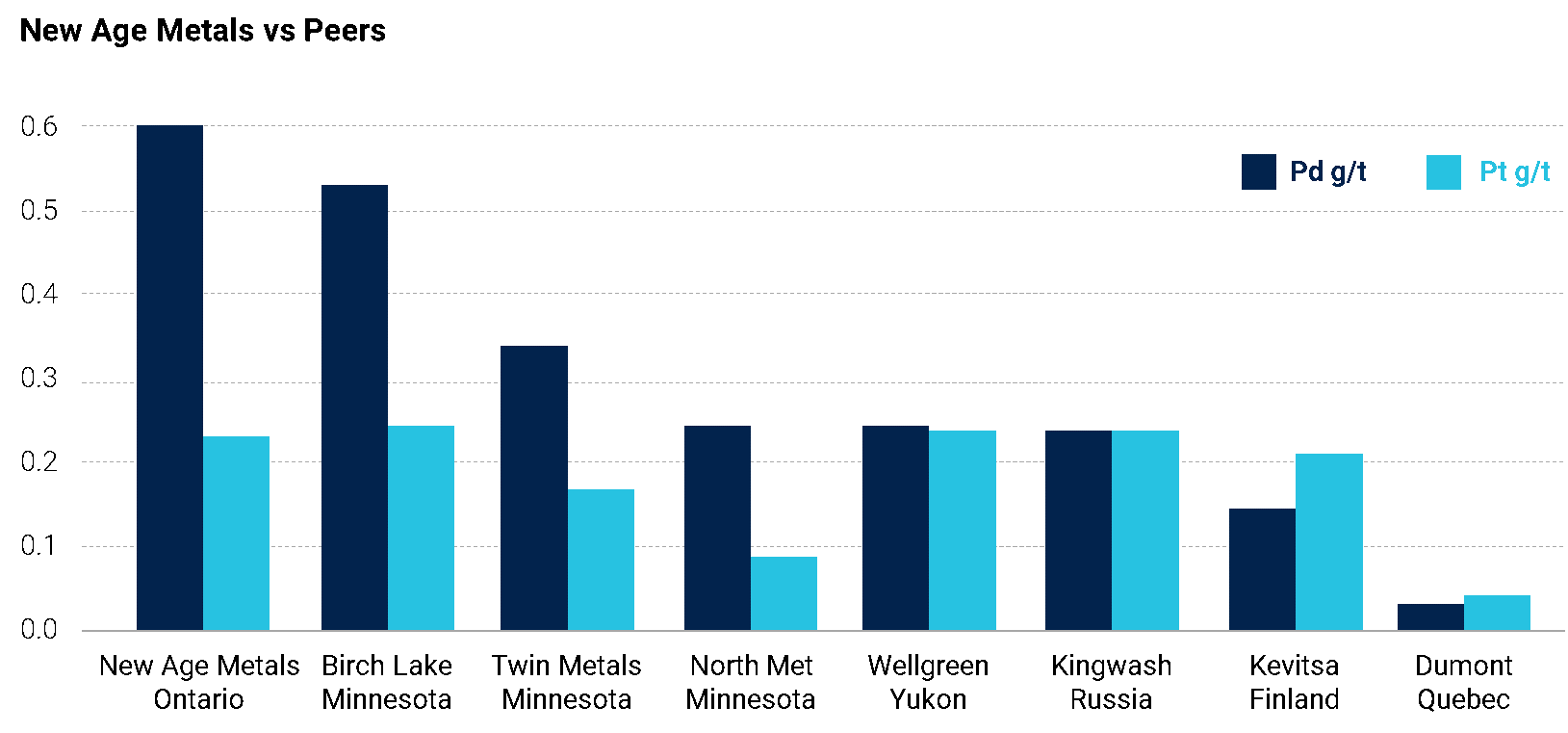

Because they are sitting on North America’s largest, undeveloped, PGM deposit.

Here’s a little about them. . .

NAM is based in Canada and focuses on the exploration of platinum group metals (PGM) and lithium.

All these metals have a bright future.

They have 100% ownership of the River Valley Project. And to date, there has been over $40 million dollars invested in exploration at the project.

The last resource estimate was completed in 2012 and it showed 2.4 million ounces of PGM’s.

But since then they have made the projects potential even larger. . .

In Spring 2015 the company announced a new high-grade PGM discovery – The Pine Zone.

Here are some of the drill results from The Pine Zone:

º Hole 2015-DN002 intersected 9 meters grading 3.909 g/t Pd-Pt, 0.121 g/t Au, 0.264% Cu from 145 meters downhole

º Hole 2015-DN001 intersected 16 meters grading 2.054 g/t Pd-Pt, 0.091 g/t Au, 0.179% Cu from 184 meters downhole

º Hole 2016-DN-T2-06 intersected 9 meters grading 4.065 g/t Pd-Pt, 0.176 g/t Au, 0.280% Cu from 178 meters downhole

º Hole 2016-DN-T2-10 intersected 4 meters grading 3.15 g/t Pd-Pt, 0.071 g/t Au, 0.190% Cu from 202 meters downhole

And in July 2016 they acquired the River Valley PGM Extension Project from Mustang Minerals Corp.

The surface grab samples showed up to 10 g/t PGM’s.

Right now, they have an aggressive exploration program underway to find and add more ounces.

Here are just a couple examples of New Age Metals value. . .

- º In September 2017, independent analyst Sid Rajeev from Fundamental Research, initiated coverage on New Age Metals with a buy rating and target price of $0.49, a 6-fold increase from the current valuation

- º Calculated in Sid Rajeev’s report, New Age Metals has an Entreprise Value/Resource of $0.68 a share

The project is moving towards development and production. There is great infrastructure around, such as accessible roads, power, and rail nearby.

It is located within 100 road-km of the city of Sudbury, Ontario which is one of the largest Nickel-Copper PGM sulphide mining and metallurgical centers in the world

They have an experienced team running this project. Management and insiders even have skin in the game – they own 10% of the shares outstanding.

As they continue to aggressively explore their property, NAM is planning to release a preliminary economic assessment (PEA) in fall 2018.

At today’s $5 million-dollar market cap – we expect big things from New Age Metals

Palisade Global Investments Limited holds shares of New Age Meta;s. We receive either monetary or securities compensation for our services. We stand to benefit from any volume this write-up may generate. The information contained in such write-ups is not intended as individual investment advice and is not designed to meet your personal financial situation. Information contained in this report is obtained from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Global Investments and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information. Do your own due diligence.