Your dose of crypto news and analysis from @BTO and @Goldfinger

WTF?!

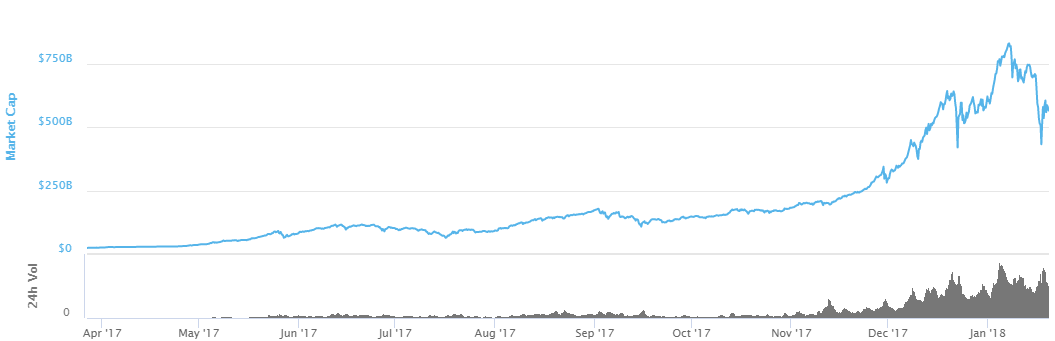

In 2018 Week 2 (i.e., last week) we had some fake Korean FUD that tanked the global crypto market cap to the tune of US$100 billion — from around US$740 billion down to US$630 billion — to which 2018 Week 3 said, “Hold my beer.”

Yep — on the weekend, the global crypto market was back humming around US$750 billion, until — POOF — US$300 billion was wiped out in just a couple of days bringing it down to a dismal US$417 billion. Even though we crossed that market cap figure for the first time ever on Dec. 7, 2017, it felt a little like this:

And after the initial sting wore off, we were left a little like this:

Of course, the usual suspects chimed in with their chorus of “I told you so’s” and doomsday proclamations:

The following one is particularly rich — for the first time since December?? You mean 1 month ago?? Oh no!!!

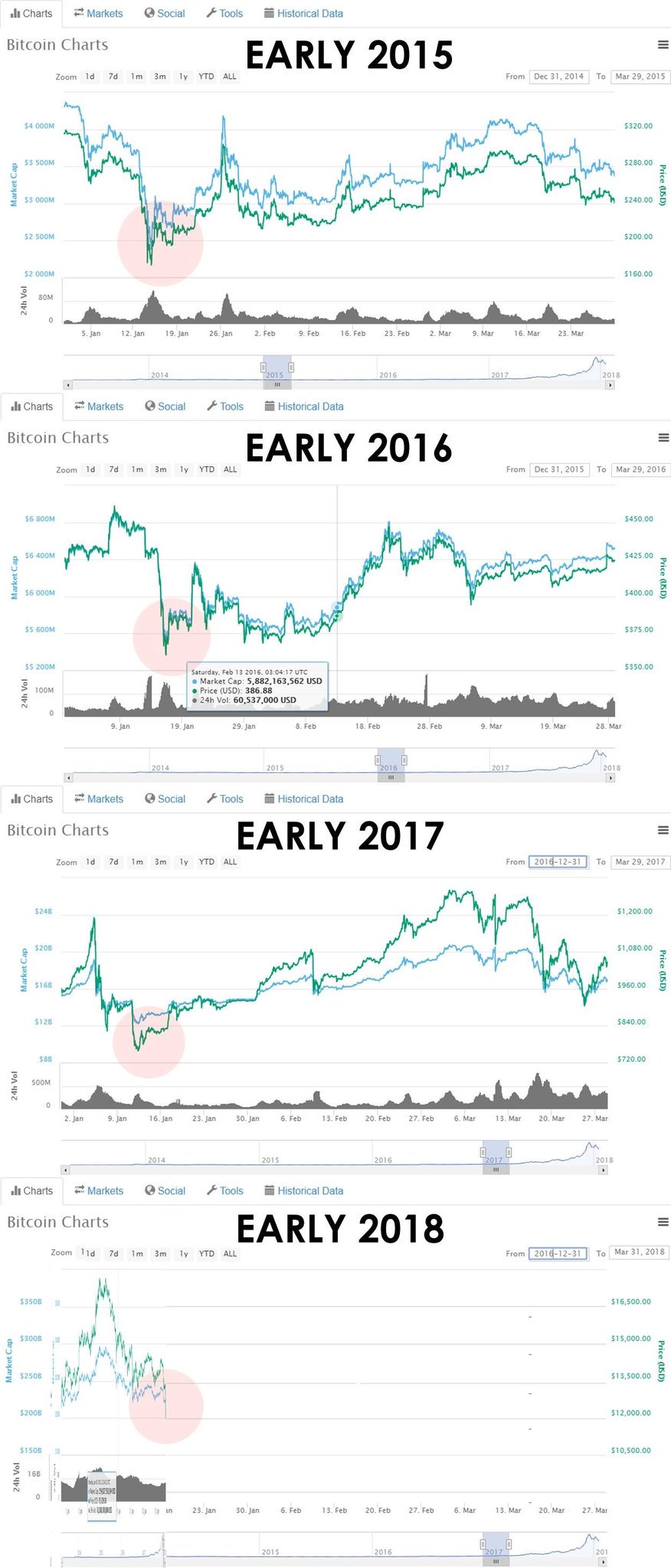

And, as sure as shit, the cryptos bounced like they ALWAYS do in January:

Don’t believe me?

It will still take some time for the cryptos to get back to where they were in December / early January, but it seems the worst is behind us.

Let’s take a look at the numbers of some of the major cryptos this week (close UTC time last Friday to today):

- Bitcoin trading around US$11,400, down 18% on the week

- Ethereum trading around US$1,030, down 19% on the week

- Bitcoin Cash trading around US$1,750, down 33% on the week

- Litecoin trading around US$190, down 20% on the week

- Stellar trading around US$0.50, down 27% on the week

- Dash trading around US$830, down 21% on the week

- Monero trading around US$346, down 12% on the week

- Ethereum Classic trading around US$31, down 12% on the week

- ZCash trading around US$504, down 28% on the week

Good buying opportunity at these levels?

To those who bought at the highs, remember:

But, in all seriousness, also remember that cryptocurrencies and tokens are a new asset class and investing in them needs to be thought of in a new way. HODL.

WTF did I miss this week in crypto?

[Hint: Regulation was the theme this week…]

France Comes Out Against Bitcoin and Digital Currencies, Wants Tough New Laws — http://www.trustnodes.com/2018/01/15/france-comes-bitcoin-digital-currencies-wants-tough-new-laws

Bruno Le Maire, the French Minister of Economy, has strongly come out against this space today in a Press Conference, stating according to a rough translation: “We want a stable economy: we reject the risks of speculation and the possible financial diversions linked to bitcoin.”

German Central Banker: Cryptocurrencies Must Be Regulated On a Global Scale — https://www.coindesk.com/german-central-banker-cryptocurrencies-must-be-regulated-on-a-global-scale/

The director of Germany's central bank quoted as saying: “Effective regulation of virtual currencies would therefore only be achievable through the greatest possible international cooperation, because the regulatory power of nation states is obviously limited.”

Korean Cryptocurrency Investors to See Fines for Private Trading Accounts — https://www.ccn.com/korean-cryptocurrency-investors-see-fines-private-trading-accounts/

In what seems to be the most “real” / definitive news coming out of Korea on the regulatory front, it is reported that Korean cryptocurrency investors and adopters who refuse to include their real names into their anonymous virtual trading accounts will be fined. Korea’s clampdown on anonymous cryptocurrency trading continues as authorities weigh up fines for adopters refusing to divulge their real identities.

But is the clampdown in Korea all it's cracked up to be? The formerly largest crypto exchange in China, OK Coin, as well as its biggest competitor, Huobi, have announced they're launching trading platforms in the South Korean market. And there's more positive news too:

China Escalates Crackdown on Cryptocurrency Trading — https://www.bloomberg.com/news/articles/2018-01-15/china-is-said-to-escalate-crackdown-on-cryptocurrency-trading

Says Bloomberg: according to “people familiar with the matter” China is escalating its clampdown on cryptocurrency trading, targeting online platforms and mobile apps that offer exchange-like services. More on this here. (https://www.coindesk.com/pboc-official-calls-for-wider-ban-on-chinese-crypto-trading-report/) But some say who cares, just FUD:

“Don’t take away our happiness:” South Koreans ask the government to stop its crypto crackdown — https://qz.com/1180342/south-koreans-petition-against-the-government-cryptocurrency-crackdown/

The ongoing regulatory saga in Bitcoin-obsessed South Korea has triggered a public uproar. A petition demanding the government to stop regulating cryptocurrencies garnered more than 200,000 signatures by Tuesday (Jan. 16). This means that the government must give an official response, which could lead to the opening of an investigation.

Translation of the petition: “Korean people can dream a happy dream that we’ve never been able to in South Korea, thanks to cryptocurrencies. I might be able to buy a house in a country where it’s very hard to buy a house. I might be able to live a life doing something I want to do. I might be able to take a breath. Please don’t take away our happiness and dreams that we could have for the first time living in South Korea.”

Proposed US Task Force Would Tackle Crypto Use in Terrorism Financing — https://www.coindesk.com/proposed-us-task-force-would-tackle-crypto-use-in-terrorism-financing/

In the U.S., lawmakers are eyeing the formation of a new task force to combat the use of cryptocurrency in financing terrorism and other illicit uses. Curbing trading activities does not yet appear to be a focus.

Earlier in the week, U.S. Treasury Secretary Steven Mnuchin was quoted as saying: "We are very focused on cryptocurrencies… We want to make sure that bad people cannot use these currencies to do bad things… I want to make sure that consumers who are trading this understand the risks because I am concerned that consumers could get hurt."

Quebec financial regulator AMF issues warning on cryptocurrencies, ICOs — http://www.investmentexecutive.com/-/amf-issues-warning-on-cryptocurrencies-icos

"Businesses that plan on issuing cryptocurrencies or tokens must understand and meet their obligations under securities laws. In particular, issuers and sponsors could be subject to prospectus and registration requirements," the alert says, adding that issuers should consider the staff notice issued last year by the Canadian Securities Administrators (CSA) to determine how securities laws may apply to a proposed offering.

Swift Signs Agreement With 7 CSDs to Explore Blockchain for Post-Trade — https://www.coindesk.com/swift-signs-agreement-7-csds-explore-blockchain-post-trade/

Swift has signed a memorandum of agreement with seven central securities depositories to look into how blockchain can be used for post-trade processes, such as proxy voting. The agreement is with U.S.-based Nasdaq Market Technology, Russia-based National Settlement Depository, Switzerland-based SIX Securities Services, South Africa-based Strate, as well as the Abu Dhabi Securities Exchange, Argentina's Caja de Valores, and Chile's Depósito Central de Valores.

The Anatomy of a Pump & Dump Group — https://bitfalls.com/2018/01/12/anatomy-pump-dump-group/

Very good read here, and an important education if you think you can make a fast buck in the shitcoin market. Spoiler alert: the cards are stacked heavily against you unless you’re in the inner circle. And in an alternative version of the classic coin P&D scheme, the following type of scheme involving John McAfee is reportedly going on:

- Organizers pick a coin and buy lots of it.

- McAfee is contacted about it and paid 25 BTC (his current known fee).

- McAfee also buys the coin, and then promotes it. The pump begins.

- McAfee and the organizers dump the coin on the followers.

Mark Cuban: Dallas Mavericks to Accept Bitcoin, Ether 'Next Season' — https://www.coindesk.com/mark-cuban-dallas-mavericks-accept-bitcoin-ether-next-season/

Vitalik Buterin Leaves China-Based VC to Focus on Ethereum Development — https://www.ccn.com/vitalik-buterin-leaves-china-based-vc-focus-ethereum-development/

It seems Vitalik is gearing up for a busy 2018 on the development front, which is great news for Ethereum. He announced that he has stepped down from his role as a general partner of Fenbushi Capital, which has been one of the most active investors in the blockchain and cryptocurrency sector. He said, “I expect 2018, at least within the Ethereum space that I’m best able to speak about, will be the year of action. It will be the year where all of the ideas around scalability, Plasma, proof-of-stake, and privacy that we have painstakingly worked on and refined over the last four years are finally going to turn into real, live working code that you can play around in a highly mature form in some cases on testnets, and in some key cases even on the public mainnet.”

Ethereum Nodes Are “Much More Decentralized” Than Bitcoin Says New Study — http://www.trustnodes.com/2018/01/16/ethereum-nodes-much-decentralized-bitcoin-says-new-study

More than half of Bitcoin nodes are run in datacenters according to the study, while only around a quarter of Ethereum nodes are. This is while ETH processes 4x the number of Bitcoin transactions at magnitudes lower fees with far less congestion. The study says: “Ethereum nodes are not accumulated in a single geographical region, but are more evenly distributed around the world… Ethereum nodes are geographically further apart than Bitcoin.”

Researchers find that one person likely drove Bitcoin from $150 to $1,000 — https://techcrunch.com/2018/01/15/researchers-finds-that-one-person-likely-drove-bitcoin-from-150-to-1000/

To many it’s been obvious that the Bitcoin markets are, at the very least, being manipulated by one or two big players. “This paper identifies and analyzes the impact of suspicious trading activity on the Mt. Gox Bitcoin currency exchange, in which approximately 600,000 bitcoins (BTC) valued at $188 million were fraudulently acquired,” the researchers wrote. “During both periods, the USD-BTC exchange rate rose by an average of four percent on days when suspicious trades took place, compared to a slight decline on days without suspicious activity. Based on rigorous analysis with extensive robustness checks, the paper demonstrates that the suspicious trading activity likely caused the unprecedented spike in the USD-BTC exchange rate in late 2013, when the rate jumped from around $150 to more than $1,000 in two months.”

Bitconnect, which has been accused of running a Ponzi scheme, shuts down — https://techcrunch.com/2018/01/16/bitconnect-which-has-been-accused-of-running-a-ponzi-scheme-shuts-down/

Amid the market carnage, Bitconnect, the lending and exchange platform that was long suspected by many in the crypto community of being a Ponzi scheme, has announced it’s shutting down. The platform was powered by a token called BCC (not to be confused with Bitcoin or Bitcoin Cash), which is essentially useless now that the trading platform has shut down. The token plummeted to about $37, down from over $200 just a few hours prior to the announcement.

PayPal's Wences Casares: 'I Can Imagine A World In Which Bitcoin Becomes A Global Standard Of Value' — https://www.forbes.com/sites/ktorpey/2018/01/15/paypals-wences-casares-i-can-imagine-a-world-in-which-bitcoin-becomes-a-global-standard-of-value/#38b9dc0d63b5

“A blockchain of four banks — it’s a database of four banks,” added Casares. “It’s nothing new. That’s not really a blockchain. A blockchain is something where you don’t have to trust any counterparty.” In Casares’s view, Bitcoin is the only blockchain working at scale in this manner, and that is due to the financial incentives around mining the bitcoin asset.

Speaking of which, Jan. 13 marked an important milestone for Bitcoin when 16.8 million BTC, or 80% of the entire Bitcoin supply, were mined. This means that only 4.2 million BTC, or 20%, are left to mine until its 21 million supply cap is reached.

South Korean Officials Initiated Insider Trading, Bought Bitcoin Before Trading Ban Fiasco — https://www.ccn.com/south-korean-officials-initiated-insider-trading-bought-bitcoin-before-trading-ban-fiasco/

According to Choi Heung Sik, the director of South Korea’s Financial Supervisory Service (FSC), the country’s integrated financial regulator that examines and supervises financial institutions, several officials and employees of the FSC sold bitcoin immediately before the premature statement on a possible cryptocurrency trading ban was released by Justice Minister Park Sang-ki.

SEC Outlines Reasons for Reluctance to List Cryptocurrency ETFs — https://www.coindesk.com/sec-outlines-reasons-for-reluctance-to-list-cryptocurrency-etfs/

The agency's concerns mainly focus on five areas: valuation, liquidity, custody, arbitrage and potential manipulation. As the letter pointed out, for example, the SEC needs to evaluate how a cryptocurrency-related ETF can be fairly priced given the volatility of cryptocurrency prices, and amid technological changes such as blockchain forks. In addition, liquidity remains another top issue that needs to be examined, in particular, how such innovative products can be redeemed by retail investors on a daily basis.

Coins and tokens and stocks, oh my!

[Note — Net change and % change figures are from the close last Friday to the close today.]

HIVE Blockchain (TSXV:HIVE) — $HIVE — Net Change: +$0.02; % Change: +0.6%

This week, HIVE announced the completion of Phase 1 of its GPU-based expansion in Sweden, and that Ethereum mining operations from this new location — HIVE’s most advanced to-date and the first one jointly built with partner and major shareholder Genesis Mining — had commenced. You can get a glimpse into the facility in a corporate update video posted by Genesis Mining today - click here. Very cool! The first blockchain ETFs also launched this week and both feature HIVE within their top 10 holdings alongside big names like IBM, Nvidia, Square, SAP, Intel, Hitachi, Microsoft, and Overstock. The news likely helped HIVE weather the crypto storm this week, bouncing back nicely Thursday and Friday after a significant dip into the $2’s on Wednesday. It finished the week at $3.29.

Neptune Dash (TSXV:DASH) — $DASH — New listing; trading to commence Monday, Jan. 22

A new crypto deal, Neptune Dash, is coming to the TSX.V this coming Monday. It will trade under the ticker $DASH. The company hopes to make a splash with an all-in play on the Dash cryptocurrency (currently the #12 coin with a market cap of around US$6.6 billion). The company exclusively builds and operates Dash Masternodes and plans to invest in other Dash-related technologies. They will be coming out of the gate with 80 million shares outstanding. Their latest financing -- $20 million -- was done at $0.50, giving the company an imputed market cap of $40 million. Shares issued in earlier (cheap) rounds of financing are escrowed, whereas the 40 million shares in the $0.50 round will be free-trading at launch.

What is the business? The company announced this week that it operates 15 Dash Masternodes and has acquired 15,134 Dash at an average cost of US$820 per coin. I spoke with management today and understand that the number of Masternodes is now up to 17 (which means they acquired an additional 2,000 Dash as each Masternode requires 1,000 Dash as collateral). Dash Blockchain currently compensates Dash Masternodes at a rate of 6.86 Dash per month (around 8% on a per annum basis). For the company’s initial 17 Masternodes, this translates to around US$1.2 million (C$1.5 million) per year of earnings (received in Dash coins) based on today’s market price for Dash of approximately US$830, which they intend to re-invest in acquiring additional Masternodes. The 17 nodes themselves are worth around US$14 million based on that same US$830 market price for Dash (1,000 Dash staked per node). The company has aspirations to scale to operate up to 100 Masternodes. And they also have high hopes for Dash (the cryptocurrency) to itself appreciate, as the company will be a long-term holder of the Dash coins they have staked in the Masternode structure. If you're bullish on Dash (the cryptocurrency), this is a way to own part of a Masternode operation without running one yourself. You can check out their website here.

Crypto Wars EXCLUSIVE -- Coinsquare.io — Private, but partly owned by $RIOT

The word on the street is that Canadian-based crypto exchange Coinsquare is marketing another financing. I was forwarded the term sheet this week. The company just completed a $10.5 million financing in December 2017 at a $110.5 million post-money valuation. This valuation was around 3x the valuation it had in September, when $RIOT invested in the company. Now the company is marketing a $50 million private placement ($20 million of which I understand is existing shareholders selling), with the price per share determined on the basis of a pre-money equity value for the Company of $400 million. Wow.

Other crypto/blockchain-related stocks riding the wave:

- HashChain Technology (TSXV:KASH) — $KASH — Net Change: -$0.76; % Change: -25.3%

- Mogo Finance (TSX:MOGO) — $MOGO — Net Change: +$0.57; % Change: +9.2%

- Overstock (NASDAQ:OSTK) — $OSTK — Net Change: -US$1.30; % Change: -1.6%

- MGT Capital (OTC:MGTI) — $MGTI — Net Change: -US$0.25; % Change: -5.9%

- LeoNovus (TSXV:LTV) — $LTV — Net Change: -$0.035; % Change: -10.1%

- Global Blockchain (TSXV:BLOC) — $BLOC — Net Change: -$0.02; % Change: -1.1%

- BTL Group (TSXV:BTL) — $BTL — Net Change: -$0.07; % Change: -0.6%

- NetCents Technology (CSE:NC) — $NC — Net Change: -$0.14; % Change: -5.0%

- 360 Blockchain (CSE:CODE) — $CODE — Net Change: $0.00; % Change: 0.0%

- Riot Blockchain (NASDAQ:RIOT) — $RIOT — Net Change: -US$1.97; % Change: -9.0%

- eXeBlock Technology (CSE:XBLK) — $XBLK — Net Change: -$0.23; % Change: -25.0%

- BIG Blockchain Intelligence Group Inc. (CSE:BIGG) — $BIGG — Net Change: +$0.01; % Change: +0.7%

- And a few others that have been getting some attention: Atlas Cloud (CSE:AKE) - $AKE; Block One Capital (TSXV:BLOK) - $BLOK; Calyx Bio-Ventures (TSXV:CYX) - $CYX; ePlay Digital (CSE:EPY) - $EPY; LottoGopher (CSE:LOTO) - $LOTO; HealthSpace Data Systems (CSE:HS); Stompy Bot (CSE:BOT); Imagination Park (CSE:IP); Blockchain Power Trust (TSXV:BPWR.UN) - $BPWR-UN.

It’s not really possible to adequately cover the weekly swings in the now dozens of names apparently in the crypto/blockchain game, so I would urge you to follow @Evenprime’s crypto watchlist should you wish to track them.

The CryptoTechnician Report

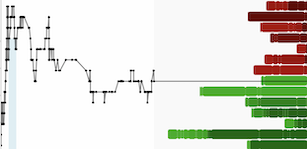

After a wild week which included a flush all the way down to the $9,200 level Bitcoin has rebounded to a layer of support/resistance between $11,000 and $12,000 - how this range resolves over the coming days will decide if a retest of $9,200 will happen sooner or later.

Ethereum found textbook support at its rising 50-day moving average and has since rebounded to touch important support/resistance at $1100:

Similar to Bitcoin, Ethereum has found itself between important support at $1000 and resistance at $1100.

Ripple, the #3 crypto by market cap, had a fantastic crash during the last two weeks after peaking on January 4th:

After a ~75% decline from its January 4th peak, Ripple has made a double-bottom at $.87 and rebounded to major support/resistance between $1.60 and $1.75. From my estimation Ripple will need repair its chart structure over the coming weeks before making an attempt at the substantial overhead resistance above $2.00.

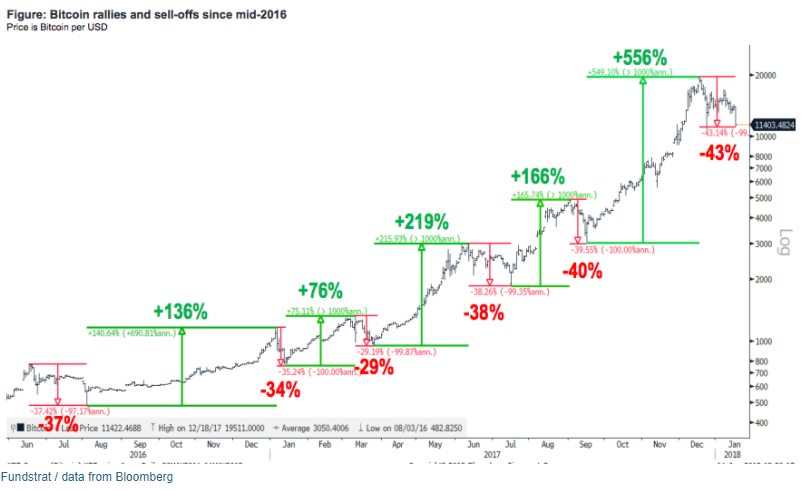

While the latest 50%+ drop in Bitcoin was scary and left many of the new crypto converts shaken, this was far from an unusual correction within the context of a massive long term bull market:

Total crypto market capitalization reached a peak of US$830 billion on January 7th and suffered a ~48% drop to a low of US$430 billion on the morning of January 17th. In the last 48 hours we have seen a rebound to just above US$600 billion with cryptos settling into a consolidation between US$550-$600 billion:

It is completely normal for the strongest bull markets, especially in the early stages, to suffer ~50% declines as often as twice per year. Things seem to happen at an accelerated pace in cryptocurrencies so volatility is likely here to stay for a long time to come.

It's also worth noting that total crypto market capitalization made a higher low relative to its low of US$419 billion on December 22, 2017 - considering the sheer amount of panic and extreme bearish sentiment we witnessed on January 17th I would consider this higher low to be a bullish divergence.

Funny things we saw this week

For the Bitcoin maximalists:

On tulips:

On the dot-com bubble:

It's always good to keep a sense of humour during a major correction.... Baby Got Back!

The Official CryptoCurrency Anthem! (self-proclaimed)

————————

DISCLAIMER — PLEASE READ CAREFULLY

All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often, but not always identified by the use of words such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "project", "predict", "potential", "targeting", "intend", "could", "might", "should", "believe" and similar expressions. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this newsletter.

The authors are online financial newsletter writers. They are focused on researching and marketing resource and other public companies. Nothing in this article should be construed as a solicitation to buy or sell any securities mentioned anywhere in this newsletter. This article is intended for informational and entertainment purposes only!

Be advised, the authors are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Crypto Wars, especially if the investment involves a small, thinly-traded company that isn't well known or a crypto asset like Bitcoin or Ethereum.

Past performance is not indicative of future results and should not be used as a reason to purchase any stocks mentioned in this newsletter or on this website.

In many cases, the authors, and/or site owner/operator Tommy Humphreys, owns shares in the companies featured. For those reasons, please be aware that the authors can be considered extremely biased in regards to the companies written about and featured in Crypto Wars. Because of this, there is an inherent conflict of interest involved that may influence our perspective on these companies. This is why you should conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities. We may purchase more shares of any featured company for the purpose of selling them for our own profit and will buy or sell at any time without notice to anyone, including readers of this newsletter.

None of the authors, Tommy Humphreys, or Pacific Website Company Incorporated (dba CEO.CA) shall be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this newsletter. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks or crypto assets, it is possible to lose your entire investment.

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that they are accurate or complete. Our views and opinions in this newsletter are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this newsletter will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

We do not undertake any obligation to publicly update or revise any statements made in this newsletter.