Just as the world was getting used to a gold (“Au“) spot price > US$2,000/oz. — offsetting years of painful mine cost inflation — it surged above US$2,100/oz. in early December. Last week it breached $2,220/oz., before receding to the current $2,176/oz.

Some pundits believe Central Bank (“CB“) buying could be behind these moves. CBs purchased an average of ~35M ounces/yr. of Au in 2022 & 2023, compared to an average of ~16M ounces/yr. from 2012-2021. The real story could be that China & Russia are leading BRICS countries away from US$ assets.

If heavy CB buying continues from this minority of countries, others might feel compelled to buy before the price goes a lot higher, i.e. FOMO… Which, of course, could send the price a lot higher.

According to Citibank,

“The most likely wildcard path to $3,000/oz gold is a rapid acceleration of an existing but slow-moving trend: de-dollarization across Emerging Markets central banks that in turn leads to a crisis of confidence in the USD”

Does $3,000/oz. seem unrealistic? That would be +38% from here. Yet, Bitcoin is up nearly +30% in just the past month. Several giant tech stocks are up > +50% over the last few months.

Goldman Sachs & Morgan Stanley are now calling for $2,300/oz., and JPMorgan & Bank of America say the price could touch $2,500/oz. THIS YEAR. Compare $2,300-$2,500 to base case assumptions in recent Feasibility studies of $1,750-$1,850.

Investors have not adjusted to this new reality. Rather than busting through all-time highs, Newmont, Barrick & Agnico Eagle are (on average) 21% below their highs. Producers will be printing money in 2024-25, so much so that we could be on the verge of a tsunami in M&A.

They say Grade is King, and I agree. I would add Jurisdiction is Queen. Few places on Earth are as prolific and mining-friendly as Quebec, Canada. Owning a significant high-grade project in Quebec’s prolific Abitibi Greenstone Belt (“AGB“) during a precious metals bull market is as good as it gets.

AMEX Exploration (TSX-v: AMX) / (OTCQX: AMXEF) is a gold exploration company with a valuable strategic partner. Eldorado Gold (market cap: $3.8B, cash: $735M on 12/31/23) holds a 9.9% equity stake.

The mid-point of 2024 guidance for Eldorado’s high-grade, low-cost Lamaque Complex in Quebec is 182.5k ozs. at an AISC of $1,230/oz. The 2017 PEA for Lamaque envisioned 11 years at 112,400 oz./yr., yet it produced 56,619 oz. (226,476 oz. annualized) in 4Q/23. This is a hugely successful mine for Eldorado.

Eldorado Gold’s Lamaque Compex a huge success…

Eldorado expects company-wide, Au-only (not Au Eq.) production growth of ~220,000 oz. to ~705,000 Au oz./yr. in 2027 vs. 2023. It would be hard to find a better mentor & partner.

AMEX’s 100%-owned Perron project consists of 117 contiguous claims covering 4,518 hectares in the heart of the AGB. No, this is not a “close-ology” play, as the entire Belt is famous for very large, and/or high-grade / low-cost mines. Perron has a multi-million oz. resource (maiden mineral resource estimate (“MRE”) out soon).

Perron has > 400,000 meters of drilling on it. AMEX has an enterprise value {market cap + debt – cash} of ~$149M. Given that the Project is surrounded by existing + past-producers, it has ample access to considerable regional infrastructure & resources including; roads, water, power, airport, labor, equipment & services.

The nearest town, Normétal, was built around a mine that has since shut down. Locals want the jobs & economic benefits that Perron offers. Luckily, last year’s forest fires in Quebec did not have any meaningful impact on AMEX.

The government is clear-cutting much of the remaining forest on AMEX’s property and is building up to 40 km of roads in the process. This will enable management to maintain easy access to target zones & low-cost drilling.

The AGB is home to Canada’s largest mines, Agnico Eagle’s Detour Lake & Canadian Malartic. AMEX, led by Victor Cantore & Jacques Trottier, PhD {see bios above} plans to deliver a maiden mineral resource estimate (“MRE“) in the next few weeks, followed by a Preliminary Economic Assessment (“PEA“) in June/July.

The Company is serious about taking Perron a long way toward production and is fully-funded through 2025 with charity flow-through dollars. AMEX has a strong, independent Advisory Board of mining engineers, exploration geologists, and experts in permitting, resource estimation & economic studies.

In addition to an advisory board, AMEX & Eldorado have formed a technical committee to help advance Perron. Tabling a robust PEA at say $1,850-$1,900/oz., with spot > $2,150/oz., will attract a great deal of attention.

The ratio of after-tax NPV to upfront cap-ex in the upcoming PEA should be compelling. To recap; high-grade, Tier-1 location, fantastic mgmt. team/board + advisory group, excellent strategic partner, tremendous blue-sky exploration potential, ample infrastructure, supportive locals, what did I miss?

Two more things, very strong cash liquidity and excellent preliminary metallurgical results. AMEX is fully-funded with ~C$30M for 50-60,000 meters of drilling this year + 50-60k meters next year.

Few juniors anywhere in the world are drilling that aggressively. None of the 120k meters will make it into the imminent MRE, which will include slightly over 400k meters.

Earlier this month management released metallurgical results from the Denise, Gratien, Grey Cat & Team zones. Overall Au recoveries (gravity + flotation + leaching) showed > 95% in all samples, and > 98% in high-grade samples.

Exec. Chairman Trottier said,

“Better than 95% gold recovery means our ore is easily processable at virtually every mill in the AGB, providing us with additional production optionality as we consider economic scenarios for mining at Perron.”

High-grade + high recovery could be a great fit for Glencore’s Horne Smelter in Rouyn Noranda, 120 km to the south.

As compelling as the drilled footprint is, most mineralization is hosted across just 4 of > 20 km in strike length. The Gratien, Grey Cat, Denise & Team zones & the High-Grade zone span that 4 km stretch. Infill drilling will try to establish continuity between some of the zones.

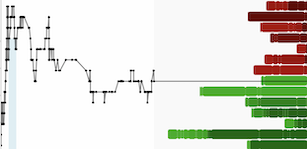

Perron is not just another Au project in Quebec, it’s potentially a Top-decile Au project in North America. Once the MRE is out, it will be comparable to the companies in the chart below. Readers should note that high-grade resources, 4+ g/t Au Eq., are rare.

I estimate that < 4% of Au-heavy projects globally — with 2.5+ million ounces — have grades = or > 4 g/t Au Eq. I’m not cherry-picking the highest-valued names to make AMEX look good, there simply aren’t that many to choose from.

Last year, B2Gold acquired Sabina Gold & Silver for ~$1.1B, equal to an EV/oz. ratio of $120/oz. Sabina’s Back River is ~3x larger than AMEX at 9.1M ozs., but it’s far more remote, in the Arctic region of Nunavut. When the deal was announced in Feb. 2023, the Au price was ~$1,890/oz.

Osisko Mining & Goldfields have a 50/50 JV on the monster Windfall project — also in Quebec — 7.4M ounces grading 10 g/t Au Eq. Osisko’s stake is valued at ~$199/oz. {Note: I ascribe 90% of Osisko’s enterprise value to its 50% interest in Windfall}. All five companies in the chart have (or had) significant projects.

The average EV/oz. of the five is $158/oz. Compare that to a few scenarios for AMEX. If the Company’s MRE shows 3M Au Eq. ounces, AMEX would be valued at $50/oz. That doesn’t mean AMEX shares will triple overnight, but to reiterate — gold bull market / M&A / tremendous blue-sky exploration potential, inc. VMS / partnered with Eldorado Gold.

If Eldorado doesn’t acquire AMEX, Agnico, Barrick, B2Gold, Goldfields & Kinross would benefit from a high-quality asset like Perron. AMEX is probably too small for Newmont… Teck Resources, Freeport McMoRan, BHP, Glencore, Hecla Mining, Alamos Gold, SSR Mining & Centerra Gold have Au interests in Canada.

In an embarrassment of riches, AMEX recently drilled 20.8 m of 3.43% Copper (“Cu”) / ~4.5% Cu Eq. on a VMS body in the QF zone, ~200 meters NE of the Team Au zone and ~5 km from the past-producing Normétal Mine that produced > 10.1M tonnes of 2.2% Cu, 5.4% zinc, 0.5 g/t Au & 44.5 g/t silver.

Management thinks they could be on to something very significant. They have 21 months’ worth of cash to keep drilling across Perron, including in the QF zone. Why should one care about AMEX’s Cu prospects? Of the dozen prospective suitors, many are interested in both Au & Cu, especially Eldorado, Agnico, Barrick & Freeport.

Investors should take a closer look at AMEX Exploration before Au stocks like Newmont recover and before a massive wave of M&A activity washes over Canada.

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about AMEX Exploration, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of AMEX Exploration are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares in AMEX Exploration, and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.