One of the companies that I highlighted at the pre-PDAC Metals Investor Forum is Fireweed Metals (TSX-V:FWZ, OTC: FWEDF). In my presentation at MIF I emphasized that Fireweed has a number of important catalysts on the horizon, including a resource update for its Macpass Project in the Yukon, and a PEA for its Mactung Project just across the territorial boundary in NWT.

With Fireweed entering a busy next several months, I figured it was a good time to speak with Fireweed Metals CEO Brandon Macdonald and update our conversation from last summer.

Goldfinger:

It's a pleasure to be speaking with you today, Brandon. Among the many accomplishments that Fireweed has had over the last few years, perhaps the biggest one is assembling an impressive set of major shareholders. How have you managed to attract such a strong list of shareholders, including the Lundin Family and Larry Childress?

Brandon Macdonald:

Larry was just an introduction from Eric Coffin in a financing from 2018 and it was a very small investment, maybe half a percent of the position he has now. But it was a willingness to answer his emails, answer his phone calls, fire back and forth text messages with him. That kept him engaged. And it's a lesson for CEOs that the shareholder that owns 200,000 shares now might own 14 million shares in a few years. And it's very hard to know who those are.

So my policy of making time for everybody who wants to chat with me was beneficial. And it's getting harder now. Unfortunately, this is due to the demands of the job. But Larry caught me at a time when I was very capable of servicing him. And with the Lundins, it was a personal connection, and that just took five or six years. And not about being a persistent salesman, because people don't want to go to a beer with you if you just launch right into selling them.

It's like your friend who's trying to sell you Amway or whatever, you're going to cut them out of the Friday night beers or the Sunday night poker sessions, or whatever, if they won't shut up about it. So personal relationships matter and progress matters. And always the progress of the project and delivering through the results and the drill bit that got the Lundins across the line. But the personal relationship, of course, helped.

And I think that there's good expression, there's no project so good that the wrong team can't screw it up. And that's true. And so ultimately what the Larry's and Teck’s and Lundin's invest in is the project, but they're trusting the management with the money. They own a piece of the project, but then they have to trust management. This is something I tell to my team quite often that our core value, of our mission, vision and values, is respect.

I said, you have to respect that every dollar we spent came from a shareholder and that's their savings account, their pension fund, their trust fund, whatever. This is where that money came from and we need to be conscious of how we spend because we should have respect for the fact that they've done that and that the retail that buy on the market, we should respect the fact that to them, a $500 or $5,000 position for them could be as meaningful to them as a $30 million position for the Lundins.

So I think when you have that attitude and you actually feel that way, I think shareholders pick up on that and I think that makes a big difference.

Goldfinger:

You've been CEO of Fireweed for seven years essentially, and you've seen all kinds of markets in those seven years. You've seen some favorable markets for brief periods of time, and you've seen some really unfavorable markets as well. What was the most effective form of marketing for you? What kinds of interactions were able to generate the most value for Fireweed?

Brandon Macdonald:

I think the most important marketing is the one that's a slow burn. I think there's a lot of CEOs who will default to marketing that has instant gratification, but those are the shortest lived shareholders. And from personal experience, we did some instant gratification marketing and it produced some buying in and moved the share price.

Unfortunately, what happens is when you move the share price too quick and on fundamentally nothing, you trade good shareholders for bad shareholders. Even when I did a big push in 2018, and I know there was nothing dishonest about that push. We didn't lie in it. The marketing, the materials were all honest. Was it promotional? Yes. But we moved so fast so quickly that even my mother sold her shares because she's like, it has gone too fast. And my dad sold his shares. So you're trading people.

If you double over six months in a gradual nice chart, almost none of your loyal shareholders will sell or sell much. And you double in a week, incredible volume on a promo campaign, a lot of your loyal shareholders are going to be like, well, this is stupid. I'm just going to take some money off the table. And odds are that money they take off the table is going to go into another quality company.

And when you drop, which you will, it doesn't necessarily come back to you. So you can actually drop further than where you started. And so that was a big lesson that the instant gratification marketing, as tempting as it is honestly, may produce net negative results in the long term. So I think when we talked about the relationship with Larry and the Lundins, that I need to have a relationship with retail and institutions.

And I think a presence on social media can be a minefield and you have to thread that needle. But I think for me, it paid off extremely well. And I think that's been our most effective marketing. Because look, I'm my own sincere self on there. Everything I say, particularly when I'm off mining, doesn't necessarily make everyone who's a Fireweed shareholder happy but I think they have a pretty clear idea that I say what I think, that I'm transparent.

And I think they realize that when I say things about politics or whatever that I'm being transparent about and that I'm passionate about, they recognize that I'm probably also equally passionate and transparent about the company. So at least they understand who they're working with. I think that's good advice to people. If you're only going to be on there to tweet your news and positive zinc news and whatever, gold dropped today or whatever, your account is irrelevant because it can be managed by someone else. It's not who you are.

So I try to be my own true self and a lot of that is responding to both tweets and just making dumb jokes. But I think people understand that. A lot of is dumb jokes about me. I take my work very seriously. That doesn't mean I have to take myself super seriously. And so I think that's a key lesson for us, has been to engage in the marketing programs that build loyalty, that build a base.

And resist the marketing campaigns that are sugar rushes that you have to go from one to the other or else. It just implodes. And if you have the time and if you have the appetite, consider engaging on social media. Just appreciate that done poorly it’s worse than not being done at all.

Goldfinger:

I like the thoughtfulness of that answer, and I think that’s a great point; with instant gratification marketing you exchange good shareholders for bad ones. Yeah, I think that's a really good point that marketing done badly is worse than not being done at all. And then CEOs who are just there to share news and positive takes on their company or their sector, there's not much value there really.

I wouldn't say there's no value because some people might read those tweets and read the articles that they share, but there's not a lot of value because they could get that stuff from a lot of other sources. So they're not getting the real person and they're not learning about who they are as a person. They're not learning to trust the person as a CEO any more than the next guy. In addition, they’re obviously only showing one very small side of who they are. And the human element is still extremely important in the mining sector. In fact, it's critical because we're investing in humans.

Brandon Macdonald:

Well, and it went back to what I was talking about. You're trusting me with your money. Do I seem thoughtful to you? Do I seem like I measure the risks and consider the rewards? Or do I just seem like someone who's promoting the story he happens to be charged with and disinterested and not really necessarily out for your best interest? And I think that's a key difference.

Goldfinger:

Passion and commitment can’t be faked. One of the things I want to see in a CEO is how much they care about the company and its shareholders. I think you’ve done a great job of demonstrating how much Fireweed matters to you, this is like your baby.

Fireweed was a standout performer in 2023, it held up very well in a challenging junior mining sector. And especially when you consider the zinc price performance, you've outperformed that by quite a bit.

Brandon Macdonald:

Yeah, in fact against our universe of zinc development peers we were the only one that was up. Not a single name was up last year, not one, not a single one of the 20 we had on our peer list. So Fireweed was up 7% last year. It was not much, but versus the peer group, we did great.

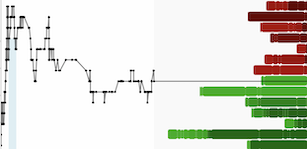

FWZ.V (Weekly)

Goldfinger:

2023 was a pretty horrendous year in the junior mining sector. So to be in the green, especially as a base metal junior, is a pretty impressive performance. And so let's have a conversation about the share price and the opportunity for investors today. The share price is down since the peak in August, down about 40%. That's a pretty good haircut. And if we just look at the seasonality, usually the Yukon juniors make an important low in March. So we're at that time of year when we usually see some sort of a bottom get put in place.

So not only is seasonality now becoming more favorable, but Fireweed has several catalysts lined up over the next several months.

Brandon Macdonald:

Yeah. Well, I guess the question is, is this the environment I want my catalyst to manifest against, right? Because you get one shot to put your resource out. You can publish another resource next year, as we may well, but good news comes out once. And how you trade on the day, this is not an efficient market. It's not like if you trade poorly in a day because there's poor macro numbers that day, that it'll just reset when the time comes. So I am anxious about publishing a major catalyst this year, but we'll do it. You don't let the market guide you too much. Yeah, you got to pay attention to it, though.

But I do think this is a key technical point we're at. I think psychologically, technically I have a love-hate relationship with technicals, that they're lovely when they're working in your favor, and the algos and stuff like that pick us up. So yeah, that's always heartbreaking. But unfortunately as CEO, I can't high close it on a day. I would get in a lot of trouble for doing that. I don't have enough of a pocketbook to do that anyways.

I heard an analyst I know and I really respect say that she thought that 2024 could be a great year for zinc just because of how bad 2023 was, just a natural rebound. And does that help us, right? I think it does. And I think what's going to help us, anything that results in our net inflow into the junior mining space. And I think that could be the gold price, as well. Weirdly, we're going to be as correlated to gold as we are to zinc because the gold price drives inflows in and out of our space, it directly impacts my liquidity. So when there's no inflows or there's net outflows, as there has been for a while, it's a zero-sum or negative sum game with you and other juniors. So it's very hard to build on that.

Goldfinger:

And yet you were able to set yourself apart from the pack and really outperform massively in the last year, year and a half. And I think about some of the weird things that have happened in the last few months that have helped to move the share price lower. You had this silver exchange traded fund (SILJ) that decided to completely dump the entire position because there was a manager change. That was very strange and frustrating. Which it didn't even make sense because the reason why they bought Fireweed in the first place was because of the silver ounces that you have in the ground at Macpass, which are quite considerable. And then they just changed manager of the fund, and they decided that they were going to follow a different index and you guys are not in that index, and so they sold it.

Brandon Macdonald:

Frustrating, and a lot of the names in the new index were no more silver names than Fireweed is.

Goldfinger:

Yeah. It was bizarre.

Brandon Macdonald:

Yeah.

Goldfinger:

And so that knocked FWZ down over 10% in a single day, and the selling was going on for two or three days. That's one factor. Obviously the zinc price and all the China fears the last few months have certainly been a major headwind for Fireweed. And then this all happens during your seasonal lull, during the winter. You're just not going to have quite as many catalysts, or traders aren't going to be quite as interested because you're not out in the field during the winter. So in my mind, this is setting up really quite nicely, and I noticed that there has been some insider buying in the past couple months.

You and your VP of Exploration, he's been buying shares I think for the first time ever, right?

Brandon Macdonald:

No, he's bought before, mostly in private placements. I don't know if he's bought much in the market before, but he did four buys. And Alex, our VP of Corp Dev did a buy or two, as well. It's an important signal to the market that we're all pretty passionate about the project. And Alex made a move from being a banker at CIBC to joining Fireweed, very much specifically to join Fireweed. He saw a lot of deals. And he wanted to come join this one. So okay, I obviously have to eat my own cooking, but he didn't have to. He didn't have to come join us.

Goldfinger:

So let's talk about the resource updates. So 2018, you put out the maiden resource. It was about 50 million tons total in all categories, about 10% zinc equivalent grade on average, but a lot has happened in six years. So I have no idea what to expect exactly. But just thinking about the results that you've had since 2018, the first number that comes into my mind, and again, I have really no idea, I haven't even read any reports as to what to expect, but I would think could the resource double in size?

Brandon Macdonald:

It's going to be ballpark in that area. And I don't know, we're not far enough into the process for me to know details yet. But if I was, I couldn't buy in the market. So I'm not blacked out. We're expecting delivery mid-ish Q2, we hope, with that resource. It's going to be a moving target, that guidance, because they might come forward, it might move back a little bit, it depends.

Tom and Jason are going to have grown a little bit. We're going to lose a little bit, too. If you take the old resource, we're going to lose a little bit from that because of the way resource estimation has changed between 2018 and now. So in 2018, the CIM guidance was not yet to constrain everything by open pit or on the ground. And so what you had was unconstrained resources, which is that you had material that didn't need to fit into a mining shape. So you can have these little blobs that were not reasonable to mine, but you could model the blobs so they appeared in a resource.

So the 2018 resource was unconstrained. So we had 11 million indicated 39 million tons inferred and 33 million tons of that went into the mining plan in the PEA. So the rest was low-grade or could not fit into a mining shape. So we lose a little bit to the mining shape issue. But we're going to gain more than that in Tom and Jason with the addition of Tom North, the step-outs at Tom West, step-outs at Jason, the addition of, well, the first little sliver of Tom South intersected last year. We haven't done a lot of drilling into Tom South this year, but we think that's going to be pretty material. But the big addition is down there at Boundary Zone.

Now that's where the most uncertainty is in total tonnage because you've got that high-grade massive sulfide that's pretty continuous, pretty predictable, pretty easy to model. And the near the surface will be open pit-able. At depth, it'll be high enough grade and continuous enough, so you can put some underground mining shapes on that.

Then you've got the lower-grade halo around it, which we were originally drilling. Those holes are where we saw the 230 meters of four and a half percent zinc sort of stuff, that heterogeneous material. Four and a half percent isn't a high enough grade to be underground. So the big question mark there is how much of that could we pull into a pit? Because whether we have 20 million tons of that, 30 million tons of that, 50 million tons of that, 80 million tons of that, how much of that, unconstrained it might be that way, but constraining it by open pit, how much of that gets pulled into the pit? Is it half of what the unconstrained resource is? Is it two thirds? And I legitimately don't know yet. So that is going to be the biggest swing in the resource.

Now, it's the biggest swing in the resource and the lowest grade part of it. So it's not, from a purely economic standpoint, the biggest deal whether we come in at 70 percent bigger than our last resource because we just didn't pull in a lot of that low grade. Or whether we come in 120 percent bigger than the last resource because they're holding a lot of that low-grade, the economics constrained is not going to be anywhere near that large between the two.

So I think that's the big question mark, but it is going to be a lot bigger. And I think he will pit constrain a lot more of Tom than was in the pit in the 2018 PEA, which I think for the people who are sharp should consider what that means to the economics. We very meaninglessly constrained the pit in the 2018 PEA for reasons, that now that we've been on the project for a while, we’re saying, "Why did we do that?" Just to make it difficult?

There's this creek at the site. It's the creek that runs by the camp, and it’s dead. It's like 2.5 pH because of the natural ARD there, and it's seasonal, without a flow in winter, or anything like that. And we'd only been on site one summer, and we didn't know a lot about that creek, that it was seasonal like that. And so we decided, well look, probably best not to disturb a creek. That could be a social license issue. So we kept the pit 20 meters back from the creek. So it's not have to be diverted. This is a sensible conservative thing to do.

Now, six years later, nobody cares if we divert a seasonal creek that has zero life in it. Nobody's going to care. So that was a totally artificial constraint, and I think that's going to allow us to have a bigger, significantly larger pit at Tom, which could really drive economics. People don't know the difference between two and a half year starter pit, which they had in 2018 and maybe a, I don't know, I hesitate to guess what it might be, but maybe a five, maybe an eight, a 10-year pit life. Also we have to consider what Boundary can contribute before you're going underground. That could be something that looks like very different economics.

Goldfinger:

Yeah, and I imagine the average grade is going to hold about the same. It might even, in certain categories, maybe in the indicated category, it could actually go up?

Brandon Macdonald:

Yep, it could. And I think that, initially, the indicated grade from 2018 was lower than the inferred. You would think, wouldn't you have done more drilling in the high grade zones? And the answer is yes, but the high grade zones change faster, so you actually need tighter drill spacing in the high grade zones to get indicated than you do in the low grade zones. So that's why more of the low grade ended up in indicated because it was more predictable. So we'll see a change in that.

Now, I think the average grade is going to come down just because of the effect of that low grade halo, and the addition of Tom North. I don't really know how much.

So I think the key thing is that we'll have more high-grade material than we had last time. That's for sure. And if you raise the cutoff to whatever you want, then you'll find that cutoff to both resources, you're going to see we have a lot more high grade in the new one than the old one. And I don't think the addition of a bunch of low-grade that drags the average grade down should be viewed as a negative, because if nothing else, that's just optionality. You can't build a project on optionality, but it doesn't hurt to have it in your back pocket, either, if the project's otherwise justifiable.

Goldfinger:

So we're sitting here today, the market cap is about C$150 million, so it's about US$110 million, and obviously that's down from more than $200 million over the summer. But if we are talking ballpark, a hundred million tonnes, it might not be a hundred million tonnes in Q2, but eventually it's going to get there, or even exceed that number. And a lot of people don't really get zinc grades or zinc equivalent grades, but just sort of ballparking it, even on a conservative level, a hundred million tons with a 10% zinc equivalent average grade, if we translate that into gold terms, we're talking about 10 million ounce deposit at a three to four gram per ton average grade. Just ballpark.

Brandon Macdonald:

Yeah. Well, you'd have to think, and I don't know what the math is, I would get fined for making that comparison.

Goldfinger:

Right.

Brandon Macdonald:

But I think most people do NSR cutoff now. So you'll see our NSR calc, and that's your revenue at mine site, right?

So it's the fairest way to compare between zinc and gold if the readers want to do it at home. And that's an important thing because I tell you what, if you do it on a raw rock value basis, it suggests that zinc projects or base metal projects are better than they are, because the percentage of revenue for gold project, the percentage of revenue that your NSR as a percentage of the raw rock value is higher than it is at the base metal project.

Because you typically have better recovery. You have better payables because with zinc you only get paid 85 percent of your metal. You don't have treatment charges, you don't have to ship concentrate often for precious metals. And the concentrate shipping is a deduction from your revenue. It's not a cost, it's actually a revenue reduction in your NSR. Because the NSR is your revenue at the door of a mine.

So I think that's a good thing for readers to consider is to not use a raw rock value or gross rock value.

Goldfinger:

It's actually a big mistake to do that.

Brandon Macdonald:

Yeah, exactly. Really consider NSR.

And there's no doubt that if we were a gold project, and this is something that frustrates me immensely, is that, if you're a successful gold company... If you're not a successful gold company, nobody cares about you. Just like if you're doing a non-successful base metals company, nobody cares about you. But if you're a successful gold company, it's got to be what, 30 global funds of size that invest exclusively in precious metals. And you could bet every single one of those, or probably 28 or 30 owned Great Bear. And so you just get a huge tailwind, as a precious metals company, if you have a success, because every single one of those funds comes behind you. Now are there some critical mineral funds? Yep, there are, and there's more every year. But the dollar value managed by critical metals funds is a fraction of what's precious-focused.

Goldfinger:

But the good thing is that it's a growth sector. So there should be more capital flowing into those funds in the coming years.

Brandon Macdonald:

Yes. And I'm going to make a bold suggestion that we might see parity between critical and precious metals funds under management in 10 years, certainly by the peak of the next bull market, right? Because I think you're going to see a lot, as all these major endowments, et cetera, family offices, are like, "I want exposure to metals because there's a metals bull market." And they're going to say, "I don't want gold because of ESG." Because even though Bob Quartermain is saying gold should be a critical mineral, that's nonsense. And so ESG-focused funds or endowments or whatever, with mandates in that regard, are you going to say, we don't want precious metals. We're not digging up the ground to put the product in a vault.

Goldfinger:

I think we're already starting to see that, honestly. I feel like that is one of the reasons why the gold mining sector has been so dreadful in the last year. I think that some of that, I mean, when you look at gold has closed above $2,000 an ounce for 14 weeks in a row, then look at the Newmont chart. Look at the Barrick chart. Yeah, there's definitely net selling of gold mining stocks in the last year. And I think a lot of that has to do with the fact that, well, some of these fund managers cannot rationalize having these stocks in their portfolio based upon their mandates. And so they need to have base metals, copper, zinc, nickel, lithium, to sort of check that clean energy box.

Brandon Macdonald:

Yes. And I can't tell you who, but I can tell you I had this conversation with a senior, like a major gold mining company who was looking at critical mineral assets. Because they took a look at their cost of capital versus base metal senior. He said, our cost of capital is lower. They thought that was going to switch. Their cost of capital was going to end up being higher because they were going to have less access to capital than the base metal, critical metals producers. So they figured this was their window while their cost of capital is lower and they can outbid the base metals companies to go in and buy critical mineral projects.

So we've had a very non-zero amount of gold companies look at our projects.

Goldfinger:

That's interesting.

Brandon Macdonald:

And we haven't seen a lot of movement on that front yet. You've got Barrick talking a good game about copper and they're building Reko Diq, and you got Agnico buying into Canada Nickel, was it? Yeah. But it's early days for that, right? I think you're going to see a lot more of that. Then it's these best-in-class projects that suddenly are going to have a lot more bidders.

Goldfinger:

I think that's very interesting ,and that's a value added sort of information there, that this is a trend that is in its early days. And it will be a tailwind for stocks like Fireweed, and it will be a headwind for gold stocks. And it's likely to be a secular theme. It's not going to be just a couple years, and this is something that could go on for 10 or 20 years.

Let's get back to Fireweed and talk about the drill program in 2024. I know you're still working on it. It's not finalized, but just looking at your drill results and looking at some of the results you had in 2023. And just, it seems like you have a really target-rich environment there at Boundary. And as you continue to move to the northwest there, there's a lot of blue sky there.

And then you have this Tom South, which you put out a great hit a couple weeks ago. How do you prioritize when you have so many targets, and the results continue to be so good, both to the north and to the south?

Brandon Macdonald:

Yeah. Well, it's tough. I think this year there's going to be a good amount of drilling at Boundary and Tom and probably adjacent to and step outs, continued resource growth. I think it's quite likely this year we do a pretty comprehensive regional exploration program, as well. The largest we've ever done, I think our exploration program in terms of geophysics, soil sampling, prospecting, mapping, et cetera, this year is probably going to be bigger than a lot of our drill programs have been in years in the past, in terms of dollars. So we're serious about regional exploration this year.

And that's a multi-year effort because it often takes a year to get the data and then you got to firm it up and go back and look through your best anomalies and decide if you're going to drill them. We were lucky with Boundary that, what we called Boundary West, we did the gravity survey and turned around a field level map to a target to a drill hole to discovery in one season. That was 2020, which was a short season.

We didn't get in until the end of July because we weren't sure we were going to have a program because everyone was stuck at home. So there are a couple of targets we'll test for sure next year, some new ones, and we might firm up some of the other targets. We've got a whole bunch more and we'll hope to find some more, as well. But I think that's going to be a big driver of budget and plans and focus, this year as well.

At the same time, there'll likely be some infill. We're not yet kicking off a comprehensive methodical infill program to get this to a PFS, but we want to make sure we have infill or certainty in areas that are economically important while being geologically uncertain.

Imagine if you're a senior mining company and you're taking a look at Fireweed, and you're the geological team, your engineering team is running the numbers on it. And they're like, "Yeah, the economics look really good, but the economics hinge on this zone here, these two zones which are still mostly inferred." That's going to give them pause.

So what I'd rather, is still be mostly inferred, but the stuff that the economics really hinge on, is drilled to an indicated level, and maybe bits of it are drilled to measured just to show good conversion.

Goldfinger:

Starting in 2017, I remember the Roads To Resources program was announced by the Prime Minister amid quite a bit of fanfare. I'm not really sure how much has happened since then, but I know that part of that program had a direct effect on MacPass. How has the Yukon evolved since you've been CEO of Fireweed? Like pros, cons, and what's the status of that Road To Resources Program?

Brandon Macdonald:

That was the Resource Gateway Project, and that was when announced in 2016, it actually did not include us. And then in 2020, some of that was reallocated to us. And I think that's taken away from a project that was owned by a Chinese SOE. You can imagine that was an easy decision for a Canadian government to allocate to us instead. And I think that goes to show in part that it's not a pure meritocracy.

It's not just about the best projects getting the government money because the government is not necessarily... They're not mining people, necessarily. There may be some mining people in the government, but there's not a lot. So relationships matter a lot. And like with investors, the government likes to feel like they know you personally. They like to feel like they can trust you. They want to know that you're not some promoter just trying to make a quick buck.

So that commitment to the jurisdiction I think matters. Now, Yukon's made some big strides over the last seven years. Some of it's been more rhetoric than reality, but the reality follows the rhetoric. They start with the announcements that we intend to do X or some of that we intend to overhaul the mining legislation as they intend to do because it's currently 120 years old or whatever.

And they're overhauling the resource road legislation to allow for truly private roads, which is a big deal, which we wanted as industry, the First Nations wanted, and the government wanted. So it was just a no-brainer to get that done. It just takes time, the speed of government is not always fast. But I think you've got a real honesty within the Yukon government about where the dysfunction is. That doesn't fix the dysfunction, but it's like Alcoholics Anonymous. The first step is to admit your problem.

And I think there's been a real honesty within the Yukon government about where the dysfunction lies. Now, the next step is, okay, how do we fix the dysfunction? But at least they're not on an ostrich with their head in the sand. They fully acknowledge that these things need to be changed and we need to tweak this. And there's a willing partner in the federal government who controls a lot of legislation in Yukon because it's a territory and-

Goldfinger:

They control the budget?

Brandon Macdonald:

Exactly. So there's a willingness in the feds and an acknowledgement there as well that things have to be streamlined in terms of permitting. And really, the streamlining in permitting is mostly deduplication, right? It's getting the agencies, the various permitting bodies operating within their scope, their intended scope, and not outside their scope. Because when they operate outside their scope, you get duplication and efforts between different agencies.

And that naturally leads to a massive creep in timelines. And it also pisses off the affected parties as well. First Nations don't want to hear about the exact same thing twice. They want to be consulted on specific matters once. So in Yukon, a lot has to do with the environmental assessment processes way outside the scope. And the way I've likened it is that you compare an environmental assessment and then the eventual permitting process to say building a house, your permits, your water license and your mining license are like your plumbing permit, your electrical and that sort of stuff. Are you building to code? Very specifics.

And the environmental assessment is not about whether or not to code. It's about whether or not it should exist in the first place. So it's like a house as an analogy, the environmental assessment isn’t: is this house being built to code? Should there be a house here to begin with? And if we allow a house here, how big a house should we allow? Then the permits are about, okay, we can have a house here. It can be this big. Now you have to build to code.

So I think that the challenge for the environmental assessment has spilled over or has taken on aspects of the licensing bodies and is looking at details that aren't really intended for the environmental assessment. So there's an acknowledgement of that, which is good. And I think that's going to make a big difference in permitting timelines in the coming, I'm going to be honest, five plus years.

But at least there's an acknowledgement of that. And I love that it's a jurisdiction that when I wanted to get the Lundins on board, brought them to site. While I'm on site, I sent a text message to a government official. I was like, "I was just coming through town with some big investors. So any way you can meet me in the airport?" And they did.

Goldfinger:

That's great.

Brandon Macdonald:

They are available. For example, in Nevada or Ontario, what are the odds you have senior government people on WhatsApp?

Goldfinger:

Pretty low.

Brandon Macdonald:

What are the odds you have access to that?

Goldfinger:

It's pretty low they're going to just come and meet you on a whim.

Brandon Macdonald:

Right. So I think this is critical. Now, it's all got to be above board. But at the same time, you just have access that you don't have elsewhere. And I think that small community and the fact that we collaborate as an industry well as well, both in our marketing in terms of Yukon Mining Alliance, but also in our lobbying in terms of the Yukon Chamber of Mines. So it matters a lot.

Goldfinger:

Yeah, I think it's unique. I can't think of another jurisdiction quite like the Yukon in terms of the level of teamwork that is displayed there. So final question. For shareholders, and always a tricky one for the CEO to answer, but a rough timeline of milestones that we can expect from Fireweed in 2024.

Brandon Macdonald:

So the two big near term ones are the resource update for MacPass and the PEA for Mactung. I've been guiding, and I'll continue to guide Q2 for both of them. I think it's going to be mid-ish Q2, which I guess is May. Depending on what day you ask me, I changed my mind about which is going to come first.

I heard and I read on a ceo.ca forum for a different company because their resource was delayed quite a bit. Someone was saying, "Oh, all it takes now is a recent college graduate and some AI software and give them one week and they'll pump out a mineral resource." I'm like, that is a massive misunderstanding of the amount of rigor that goes into a mineral resource.

Goldfinger:

Give them one week and they'll generate a mineral resource?

Brandon Macdonald:

With AI software. It was asinine, this comment. But it is really a complicated thing. It requires iterations and each iteration takes quite a bit of time. So if you don't have to iterate many times it can be not fast, but faster. And it's very hard to predict how many iterations are going to be required in advance because you have to consider various things. So it's not always easy to predict. We can't say my mineral resource estimates are going to be done on May 17th.

It's not a straightforward process. So both on guiding mid Q2, pretty comfortable with that. I think Q2 definitely. But life can make me a liar so there's no conspiracy if it takes longer than that.

Goldfinger:

But it makes sense that you would have the resource update prior to the start of the exploration program?

Brandon Macdonald:

Yeah. Well, it definitely guides part of it, for sure.

Goldfinger:

Right. And then how big of a drill program this summer, you think?

Brandon Macdonald:

20,000 meters. Probably about the same as last year.

Goldfinger:

And about the same timing as last year in terms of the start of the program?

Brandon Macdonald:

Yeah, I think so. June.

Goldfinger:

All right, perfect. Brandon, thank you for this conversation and for updating me on Fireweed’s progress and plans for 2024.

Disclosure: Author owns shares of Fireweed Metals at the time of publishing and may choose to buy or sell at any time without notice.

Disclaimer: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This video is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.