Gold mining shares continued with their disappointing performance on Friday. Even on a day in which the sector traded higher, the performance was lackluster considering the price moves of the underlying metals (gold and silver).

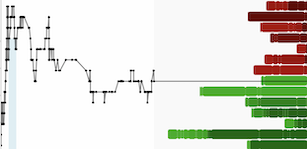

As gold sits within a whisker of the $1300 level once again, the GDX remains below the $23 support/resistance level - the last several times that gold was trading up close to $1300 (during a short term uptrend) the GDX was at significantly higher levels than it closed on Friday:

GDX/Gold/Bitcoin

I believe there are two primary reasons for the gold miners' recent sluggish performance:

- Despite gold's ~1.4% surge on Friday it remains in a range-bound oscillation devoid of a sustainable trend. Investors & traders have become accustomed to selling into rallies as opposed to holding positions OR even adding to bullish positions on price rises (a common trading technique during bull market environments).

- Cryptocurrencies have stolen much of gold's thunder in 2017 as the total cryptocurrency space has gone from less than US$20 billion in total market capitalization at the beginning of the year to ~US$235 billion as I write these words:

A potential 3rd reason for gold miners' recent sluggishness as a sector is that tax loss selling could be weighing down some of the stocks that have disappointed investors during 2017 (see Barrick $ABX and Goldcorp $G).

With more than US$200 billion flowing into cryptocurrencies globally during 2017 one can imagine that at least a 10% chunk of that capital would have otherwise been deployed to the precious metals sector. The challenge for precious metals mining investors is to figure out if/when this trend will end.

At least for now it seems there is more capital waiting to pour into cryptocurrencies before year end. However, a situation could be shaping up for investors to opportunistically add exposure to the precious metals sector over the coming weeks; just in time for a sentiment shift (as value investors buy what has recently been out of favor, and sell some of what produced big gains in 2017), and seasonal tailwinds (January/February is the best two month stretch of the year historically for gold miners), to kick in at the beginning of the new year.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.