*DISCLOSURE BEFORE ARTICLE: MiningBookGuy owns shares in Altus Strategies (ALTS on the TSXV in Canada & ALS on AIM in London), and much of the information is biased. MiningBookGuy does not have any relationship with the company, and may buy or sell shares at any time in the future. MiningBookGuy is not a registered investment advisor and advises you to do your own due diligence (DYODD) with a licensed investment advisor prior to making any investment decisions. This company is highly speculative and not suitable for all investors. Any errors are mine and mine alone.

----------

So is there one company that provides "ultimate exposure" to Africa?

YES, and I have no doubt that company is Altus Strategies (listed as ALTS on the TSXV in Canada, and ALS on AIM in London).

I make the case for this in my 45 minutes video above (or just click here to watch). Here are some additional notes to support the video:

1. The "Project Pyramid" - if you just get one thing from the video, I hope it's the Project Pyramid! This really gives you a good idea of how many projects are "Joint Venture (JV) Ready". New JVs make for a great catalyst. You can study the picture below from the recent Powerpoint, and fool around with this dynamic link on the website to learn more about individual projects: https://www.altus-strategies.com/projects/project-pyramid/

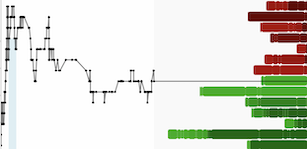

2. Making An Impact - Importantly, I email blasted this video 1 hour before the TSXV market opened on Thursday May 2nd. The stock was trading at 0.065 CAD before the open. I was thrilled to not only see the stock move up (one of the best performers on the TSXV that day), but also that there were more shares available at 0.075 CAD than I expected. In fact I saved a screenshot of the first 2 hours of trading that morning from #CEOpro (my not-so-secret weapon for accumulating shares, consider trying it out here! https://ceo.ca/about/market-depth ):

About 200k shares traded at 0.075 CAD in the first hour after the open. Do the basic math, and that's about $15k CAD. While that is a drop in the bucket for larger companies, it's a big deal for tiny juniors! Many don't trade every day (including Altus the day before). $1000 or $2000 CAD is a big part of the portfolio for some people, and should not be dismissed.

I still have not bought or sold any shares since the email blast (I might actually buy some shares on the AIM Listing in London...but that's just a semi-hint I don't really want to talk about right now!). I am happy to see multiple trading houses show up buying from mostly one seller. While ALTS could easily trade back down soon, this justifies the value of my free email list (if interested, click here to sign-up). It's possible a 'new floor' is already being created for ALTS!

Another way to consider this small, but meaningful, impact - Check out my response to Peter Spora on LinkedIn below (I was thinking of the CEO.CA crowd when I wrote this):

3. Confidence in the Management Team - I feel I could have discussed management's background a bit more in the video. Below is a snapshot of their collective experience from the recent Powerpoint. I think it's worth scanning, as it's hard to find ANY team with such deep experience across Africa:

4. Out-Of-The-Money Warrants -

I want to emphasize that the stock is still trading under 0.10 CAD, and the vast majority of warrants are priced at 0.30 CAD. There is NO overhang until the stock goes up 3x-4x! This supports why Altus is potentially a very good speculation for retail investors at this level. There is no funny business with the capital structure.

See below for further information, including warrants and capital structure -

Share Price as of the open, Thursday May 2nd, 2019: 0.065 CAD

Market Cap at 0.065 CAD Share Price: ~$11.6M CAD

Capital Structure and Significant Shareholders from the most recent Powerpoint Slides:

Website: https://www.altus-strategies.com/

Recent Altus Powerpoint: https://www.altus-strategies.com/site/assets/files/3914/altus_-_exec_presentation-_q2_2019.pdf

+(1).png)