“Skin in the game” is of well-known relevance in the investment world. On the topic, Frank Holmes previously delved into the world of fund management and fortune 500 company stewards, recognizing unique opportunities to invest on equal terms with some of the greatest minds and managers of our time; men with skin in the game: Bill Gross, Warren Buffett and Elon Musk, to name a few.

Warren Buffett, widely credited with coining the phrase in this context (although he denies the attribution) epitomizes alignment between an issuer’s management and its shareholder base. Buffett holds 308,400 Berkshire Hathaway Class A shares worth over $58 billion today, a figure he says is 99% of his net worth.

At the 2014 Berkshire Hathaway general meeting, Buffett stated “We have no interest in large salaries or options or other means of gaining an "edge" over you. We want to make money only when our partners do and in exactly the same proportion.”

To truly align themselves with shareholder’s interests, management must have skin in the game; equity in the company. When the stock price fluctuates, they should be affected proportionally. Options can be a useful tool but they have a couple of important shortcomings: they are time sensitive - therefore value expediency over stability - and reward upside without punishing downside.

Nassim Taleb used a suitable analogy in the book “Antifragility”, where he spoke about how the ancients used skin-in-the-game tactics. Hammurabi’s Code of Laws prescribed that:

“If a builder has built a house for a man, and has not made his work sound, and the house he built has fallen, and caused the death of its owner, that builder shall be put to death. If it is the owner's son that is killed, the builder's son shall be put to death.”

Make the builder suffer the same fate as the owner for poor or rushed work and the builder will protect the owner’s interests. The builder also knows more about the risks relating to the project than the owner could ever hope to.

“The person hiding the risk has a large informational advantage over the one who has to find it,” stated Taleb in a New York Times Op-Ed.

There’s extensive public disclosure and reporting in the investment industry, but knowing every challenge that a company faces on a day-to-day basis is impossible. For investors, tools like SEDI and CEO.CA simplify our job.

Imagine as an investor, sitting in a meeting with a CEO who is pounding the table saying that the company’s stock is trading for pennies on the dollar. The pitch is convincing and the deal’s fundamentals check out.

You return to your desk and look on SEDI to check the insider transactions of the company. It’s a short list, mostly detailing the options packages of management and directors.

You scroll across the name of the CEO and notice that, although this person has worked for the company for three years, he/ she does not own a single share. The company may be undervalued but why hasn’t management put their own skin in the game? What do they know that you don’t?

It’s not as simple to measure management’s skin in the game only by the equity they hold. Importantly, what did management pay for their equity and when did they buy it? Lately, public market insider activity has picked up. Frank Giustra, Director of Sandspring Resources, purchased shares in the market a couple of weeks ago at 14, 16, and 21 cents. As a Director of Endeavour Mining he purchased Endeavour shares at $7.18 and $7.49.

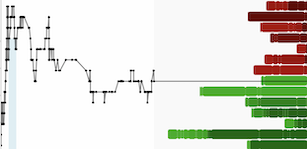

If you were following that activity, you had plenty of opportunity to do the same. Endeavour is now an $11.50 stock and Sandspring has more than doubled in the last couple of weeks, sitting at 30 cents today. Here’s a short list of other insiders that have bought their respective company shares in 2016:

These men already have significant security exposure through options. If they are willing to double down and buy in the market, it definitely warrants your attention. MAG Silver, Pretium, Pilot Gold, Detour Gold, Roxgold, Brazil Resources, Osisko Gold Royalties, and Gold Standard Ventures have all come to market for capital over the past couple of weeks. An interesting note is that insider purchases preceding the capital offerings were light, to say the least.

Tracking these insider filings could be a helpful clue - but certainly not a rule - to see if the company you are following will look to raise capital in the near future. If a CEO is willing to buy at a specific price, that is likely a sign that the company does not intend to raise capital at that price any time soon. Investors should pay attention to this right now. With the significant jump in gold equities over the past month there will be plenty of companies looking to finance.

Given the difficulties in the mining space over the past four years, investors can afford to be selective about the companies they choose to buy. Look for management with skin in the game.

The above article was written by Riley Skinner, a registered Investment Adviser with Haywood Securities Inc., a Canadian-based independent, full‐service investment firm and member of the Canadian Investor Protection Fund. The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The information contained in the reports have been compiled from sources Haywood believes are reliable; however, Haywood makes no guarantee, representation or warranty, expressed or implied, as to such information’s accuracy or completeness. The views expressed are those of the author and not necessarily Haywood Securities Inc. All opinions and estimates contained in the reports are based on assumptions the author believes to be reasonable as of the dates of the reports but are subject to change without notice. Either the author, Haywood Securities Inc. or its employees may from time to time hold or transact in the securities mentioned. He can be reached at 604-697-6178 or rskinner@haywood.com