It took a while, but gold is finally starting to move. I must admit I’m surprised it's taken this long for the market to realize something I have been expecting all along.

The Fed’s hands are tied, something we touched on in our interview three years ago. They are backed into a corner and can’t start hiking rates because the U.S. economy is not that strong. Not to mention the rising federal debt, which can’t withstand higher service costs.

Besides, how can America buck the global trend of super-easy money policy? Japan has negative interest rates and everyone else is also running the currency devaluation race. Consider, expectations of Fed rate hikes just drove the rising U.S. dollar a lot higher. That doesn’t help U.S. exports, which is why I believe we’ve seen the first and last rate hike. The global economy is lacking growth and there is way too much debt. It will be a vicious cycle.

The fact that gold took such a long pause during a secular bull market still puzzles me. It's not a stretch to say the policy makers have done a great job of talking down gold so as not to spook the system. For me, the buy signal was the Goldman Sachs call two years ago that gold would go to US$1,000. It never did and it won't. I prefer to do the opposite of whatever Goldman Sachs recommends.

Other asset classes -- the stock market, real estate, art - have all moved into bubble territory. The inflation call I made in 2013 has manifested itself in these bubbles, if not the consumer price index. It will continue to do so and I think gold is next. As Soros said, gold will be the ultimate bubble.

This entire game will unravel someday and everyone is going to get creamed. But my guess is that you will continue to see easy money strategies used by policy makers until they completely stop working -- and even beyond (as Japan has illustrated).

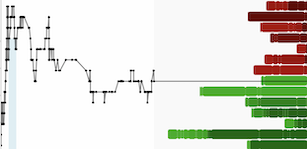

How to play it? Gold stocks are cheap. They are the best way to profit from a gold rally, in my opinion. Look for those companies that have the best leverage to the gold price. I think gold is going to go a lot higher on this run, and select highly leveraged gold stocks will jump even more.

Frank Giustra is a Canadian entrepreneur and philanthropist. He is on the board of directors of Endeavour Mining (TSX:EDV), an Africa-focused gold producer, and Sandspring Resources (TSXV:SSP), a South America-focused gold developer. Follow him on Twitter: @Frank_Giustra

Sign up, join the conversation and track your favourite stocks using CEO Chat, the investment conference in your pocket.