Mining stocks finally leveled off a bit in March after a punishing 2-month start to the year. Gold is holding well above 2100 an ounce, and June futures closed at 2210. Silver had approached 26 but has retreated once more, to a 24 handle. My own portfolio held its own as the month winds down. I did make some adjustments.

I sold the New Pacific Metals position, kicking myself for not getting out sooner, and I sold at a loss. To add insult to injury, the shares rallied after I exited. So it goes. I also exited Anglogold Ashanti, IAMGold, and Centerra, all with very good profits. I would easily buy those back on dips from here. Centerra has 500M in Cash, IAM is also cashed up with a new mine coming online, and AU offers great leverage to the price of gold.

So while I am happy with my profits, I don't really want to be out of them for very long.

Nevada

I opened new positions mostly in the US and specifically Nevada:

U.S. Goldcorp has a 1.44M oz Proven/Probable AuEq deposit in Wyoming and only 9.2M shares outstanding. I see it as a sleeper pick, as there is not a wide following for these shares. It also has two additional properties in development in Nevada (Keystone) and Idaho (Challis).

Augusta Gold is shovel-ready, permitted, near-surface and located just outside of Beatty in a district populated by Anglogold Ashanti, Kinross, and Coeur Mining. I like its chances. Management owns 31%, Barrick 10.6%.

Nevada King was my other pickup in the U.S. It is focusing down on the formerly operating Atlanta mine and has mentioned spinning out some of its remaining assets. The strip ratio for Atlanta's open-pit plan might present a bit of a problem, but I will watch and see how things go.

Suriname

I bought Founders Metals on a slight dip from its 52-week high, picking up shares around $1.18 US. I'd been meaning to buy it for a while, based on very impressive drill results. Worth a read thru their Presentation and PRs. Location is Suriname, not a country I am wildly familiar with, but I'm willing to take a chance here as I believe they are sitting on, literally, a gold mine.

Canada

I continue to hold both Skeena and Scottie Resources, in the golden triangle of British Columbia.

Silver

I bought additional shares in MAG Silver, which has been admittedly weak lately but looks like a bargain to me here with one of, if not the lowest, AISCs in the industry. My cost average is 10.02 so I am down just a bit as the shares rallied strongly today on 27 March.

I also re-entered Pan American Silver just under 14 a share. I feel that PAAS is due for better things a year after the Yamana acquisition, and as stated, gold has been strong. Pan American now operates seven gold mines, four silver mines, and has Escobal still on Care & Maintenance. In my view the shares are always on sale in the $13-14 US range.

Mexico exposure remains Vizsla Silver and GoGold Resources, along with MAG.

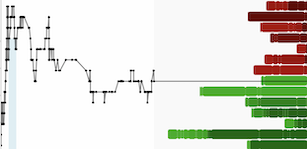

Silver continues to trade in a range so far, repeating what it did for most of 2023. Investors continue to wait for a break-out, which would occur sometime after breaking and holding above the 26/oz level. Support is at 22.

A 1-year chart of silver on the weekly follows, illustrating the up-and-down cyclicality over the past 12 months.

+(1).png)