I was heavy Cash thru most of the summer. Still, the portfolio was taking hits. I watched in disbelief (as likely did most investor/speculators in the precious metals space) as a market so poor in sentiment got steadily worse.

SILVER

First, there was dependable GoGold Resources (formerly my #1 position) trending lower right from the start of the year, finally reaching nadir at a low of 80 cents US the week of 6 Nov. Previously trading near a buck a share only with the alleged SILJ "rebalance" of Sept 2022, it looked for a while in peril of slipping back towards the Covid lows before recovering after the Thanksgiving holiday. Discovery Silver was another company with a large silver resource that took a trip down to 40 cents US. Now I know Mexico has its issues, but that just seemed ridiculous. Personally I did not catch that absolute low, but did manage a couple of buys there in the mid-40s. It's a hold for me at the moment, as I am close to full and DSV is now my #1 position. New Pacific Metals, had been holding well above $2 US most of the year, but a 35M unexpected financing in September dropped it like a rock. I was buying all the way down to US 1.40 a share in early October, again did not catch the absolute low, but accumulated a position at what I believe to be some very good prices. Finally, Bear Creek Mining, a company that I owned in the distant past, watching it drift along at 40-50 cents, suddenly collapsed, dropping 50% in one day, (25 Sept) on yet another financing announcement. I was too early that day at 20 cents. The shares eventually dropped to 12, I averaged down, and hold a position now at breakeven between 15 and 16. I happen to like the Corani project, so I hold on.

Latecomers to the portfolio. I added Guanajuato Silver at 20 cents US. The company has impressed me with its ability to grow production in a very short time period. Cash costs and AISC remain high but I expect those to steadily come down. I also like the CEO. Endeavour Silver, which is one of the highest cost producers in the industry, was another add in December, at just under $2 US a share. My gut feel is that they turn things around with Terronera expected to come online this year, and I am hoping for an overall improvement in Mexico. MAG Silver was my final add to the portfolio in November, and I over-weighted it. The shares have not been performing especially well, but I wanted a high-grade producing mine with growth potential. Being one of the lowest cost producers at 9.12/oz AISC doesn't hurt either. My other holdings are mid-tiers SSR Mining and Centerra Gold.

I missed out on a few buys. Dolly Varden traded briefly at 0.42 a share US not too long ago (Sept) and for some careless reason I passed on it. Hercules Silver had been trundling along at 16 cents, hit a 2% Cu interval and quickly ripped to over a dollar. Eloro Resources traded at an astounding (close to 4-year) low near a dollar, and I let it go. There is an element of psychology involved in trading, and fear is often stronger than greed. When it is exactly the time to buy, that seems to be when we shake our heads no.

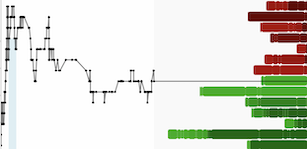

Silver basically ended the year where it began. It peeked thru 26 a couple of times, could not close above, and spent most of the year on a seesaw. Lowest weekly close of 20.51 (6 March), followed by a beautiful rally that lasted thru about mid-April, and then the wheels started to come off. High weekly close for the year all the way back on 1 May at 25.93, and a few violent sell-offs in between.

I ended up +3.4% in my tiny mining portfolio, which represents about 5% of my net worth. Another 10% is allocated to bullion, 5% in two Vanguard bond funds, and the rest sits in Money Market accounts. Yes, I can plow a lot more cash in, but I'm kind of skeptical for 2024. I see more and more often lately bullish comments on the metals, mostly founded on expectations for interest rate cuts next year. But these comments come from people who are almost always bullish. They seem to overlook macro risk (likely recession in the US, or a general market collapse after the Nasdaq's 47% gain or the Top 20 gainers in the SP500 ripping up between 82 and 239%).

Silver itself, is kind of a tough horse to ride.

Clearly I'm not swinging for the fences, although most of my stocks are high-risk speculations. If silver does eventually take off, and I see a 2x on my 25,000, I'm more than good with that.