I'm late putting this out, and already close to halfway thru March.

February was another punishing month for the mining portfolio. SSR Mining had a substantial heap leach pad collapse at its flagship mine (Copler) in Turkey. I thought I had very comfortable protection with a stop at US $4.70 but alas, the shares went thru that like a hot knife thru butter. I took over a 50% haircut on my position.

New Pacific Metals traded briefly at an unbelievable low near 89 cents US. I held fast and the shares have recovered to about 1.08 but I'm still down with an avg cost of 1.45. Still holding, and I believe the market has either mispriced it or there is something shady going on behind the scenes. Investor Relations tells me thru email communication that they believe the move is "due to the entire silver development space being hit hard", but gave no clues regarding any ETF or large position sellers. It's only a hold here, for me.

I sold out Discovery Silver and took a loss. Took another look and decided that 100 g/ton Ag concentrate was probably not going to cut it as an open-pit mine in Mexico with a Capex over 600M USD. Have great respect for CEO Tony Makuch but I have moved on from it.

Proceeds from that sale went into Vizsla Silver, Barrick Gold, Scottie Resources, and I added to Hecla Mining.

Some good news is that gold finally woke up and pushed to a new ATH, closing Fri Mar 8th at $2186/oz. I have done well with AngloGold Ashanti (+ 33%), IAMGold (+ 40.17%) and Centerra (+ 23.6%) all with mid-January entries. I might be getting a bit greedy with these, but as long as the gold trend is up, I am holding with stops just in case. I'm also at 35% Cash.

Everyone keeps wondering when silver will catch up, yet it has rallied of late, moving from 22.50 to 24.55 over the past seven trading sessions. That is a quick 9.1% gain. We'll have to see how that plays out this week, just keep in mind that 26 or so, is resistance and about 22 is support. So, still in a trading range similar to last year.

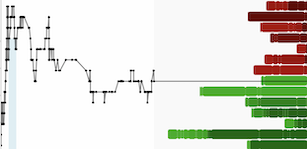

I will conclude with a 1-month chart of gold, showing good volume, strongly diverging MACD and also note that RSI has pushed thru 80 which indicates this rally probably needs a breather and some consolidation. But it is possible that 2100 is the new 2000.