I wrote at the end of the year regarding mostly silver and my holdings of Jr mining resource stocks, lamenting the poor performance and lack of buyers (as well as enthusiasm) in the sector. Then came January. It has been a cruel month. My own personal mining portfolio dropped 11%, with today the last day of trading in this, the new month of the new year. Losing 11% over the course of a year is considered a pretty dismal performance. For it to happen over the course of one month is alarming.

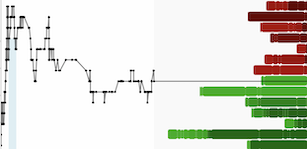

I cannot blame the price of silver. It is mostly a continuation, so far, of what was seen in 2023. Ups and downs and an overall sideways trend which wound up never really going anywhere. Price meanders along in a 22-24 USD range yet has not--thus far anyway--collapsed.

Then there was the completely unexpected so-called 'rebalance' in the SILJ ETF on Monday Jan 29th. Some Jr's advanced significantly (Vizsla, GoGold Resources as two examples), while others were unfairly punished. Millions of shares suddenly traded in the waning hour of trading that day. It didn't make any sense. I didn't react to this event, at any rate coming in the tail end of the trading day, there was little time to react anyway.

One holding which was already substantially lower even before this carnage took place, is New Pacific Metals. I have to admit I have no idea what is going on with these shares. Spun out of Silvercorp Metals by CEO Rui Feng a few years ago, New Pacific has increased its resource over two deposits, taking Silversand to 200+ Million silver ounces, and adding another 549 Million M&I ounces at Carangas. A third deposit, Silverstrike, is also under development. Some look to Bolivia as part of the problem. Yet, the projects have been in Bolivia the entire time. That's nothing new. One thing that is new, is Pan American Silver taking a large position in the shares last Fall. Pan Am now holds 11.6% of the outstanding shares with Silvercorp retaining some 27%. As Pan Am already operates in country, I wonder if there is some back room deal to take it over on the cheap, forcing the share price down while simultaneously reducing the Market Cap. There is no reason for a growing resource of this size to be down so much, while the price of silver holds relatively steady.

Other parts of the portfolio took a similar hit. Discovery Silver trended perilously close to its 52-week low near $0.40 US. MAG Silver, despite an impressive year with Juanicipio and arguably the lowest costs in the industry, was also lower, trading near to $9 a share. I made a few adjustments but didn't panic sell anything. I added to SSR Mining and also added to MAG. I re-entered Hecla Mining with a small starter position under $4 a share. I raised Cash to 25% by reducing my Skeena position and selling a couple of copper plays.

Tomorrow is already the 3rd anniversary of the infamous "silver-squeeze" event of 1 Feb 2021. How quickly time flies. I imagine most of those who participated have long since departed, disappointed by silver in general. As for me, despite current sentiment and my own growing concerns for this sector, I will stay this course a bit longer.