Unlocking Opportunities: HSBC Leads the Charge in Tokenizing Gold for Retail Investors

Original Article: https://www.juniorstocks.com/hsbc-makes-history-with-launch-of-gold-token-for-hong-kong-retail-investors

HSBC, one of the world's leading financial institutions, has taken a groundbreaking step by introducing its gold token, aimed specifically at retail investors in Hong Kong. This move marks a significant milestone in the realm of blockchain-based assets and underscores HSBC's commitment to innovation in the financial sector.

HSBC's Initiative

HSBC proudly asserts itself as the pioneer in tokenizing gold for retail investors, setting itself apart as the first bank to venture into this domain. By leveraging blockchain technology, HSBC aims to democratize access to gold investments, traditionally reserved for institutional players, and empower everyday investors with new opportunities.

Availability

The HSBC Gold Token is easily accessible through HSBC's Online Banking platform and the HSBC HK Mobile App, ensuring convenience and seamless integration into investors' daily financial activities. This accessibility enhances the reach of gold investments, enabling more individuals to participate in the precious metal market.

Technology Behind HSBC Gold Token

At the heart of this initiative lies HSBC's Orion digital assets platform, a sophisticated infrastructure designed to facilitate the tokenization of real-world assets securely and efficiently. The utilization of blockchain technology ensures transparency, immutability, and enhanced security in the issuance and management of the HSBC Gold Token.

Tokenization of Real-World Assets

HSBC's foray into tokenizing gold mirrors a broader trend within the financial industry, where institutions are increasingly exploring the tokenization of real-world assets. This trend reflects a paradigm shift in how traditional assets are represented, traded, and managed, paving the way for greater liquidity and accessibility in financial markets.

Partnership with Metaco

In collaboration with Metaco, a reputable crypto safe-keeping specialist based in Switzerland, HSBC has strengthened its position in the digital asset custody space. This strategic partnership underscores HSBC's commitment to leveraging expertise from diverse domains to deliver innovative solutions to its customers.

Regulatory Approval

The authorization granted by the Securities and Futures Commission further legitimizes HSBC's gold token initiative, providing regulatory clarity and instilling confidence among investors. This regulatory approval demonstrates HSBC's adherence to compliance standards and its proactive approach to navigating the evolving regulatory landscape.

Benefits for Retail Investors

The introduction of the HSBC Gold Token presents several benefits for retail investors, including fractional ownership, increased liquidity, and enhanced diversification opportunities within their investment portfolios. Moreover, the accessibility and transparency afforded by blockchain technology empower investors with greater control over their financial assets.

Implications for the Financial Industry

HSBC's pioneering initiative is poised to disrupt traditional notions of asset ownership and investment, prompting other financial institutions to explore similar ventures. The tokenization of real-world assets represents a transformative shift in how assets are managed and traded, with far-reaching implications for the broader financial ecosystem.

Future Prospects

Looking ahead, the success of HSBC's gold token launch may catalyze further innovation in the tokenization space, fueling the development of new financial products and services tailored to retail investors. This expansion holds the potential to democratize access to a diverse range of assets and reshape the dynamics of global financial markets.

Global Perspective

While HSBC's initiative is a significant milestone in the tokenization landscape, similar initiatives are emerging worldwide, reflecting a global trend towards digitalization and decentralization in finance. As blockchain technology continues to mature, it is likely that more institutions will follow suit, ushering in a new era of financial inclusion and accessibility.

Customer Feedback

Initial responses from retail investors and the general public have been largely positive, with many expressing enthusiasm for the opportunity to invest in gold through a trusted and reputable institution like HSBC. The user-friendly interface of HSBC's digital platforms has further facilitated adoption among tech-savvy investors, driving interest in the gold token offering.

Market Reaction

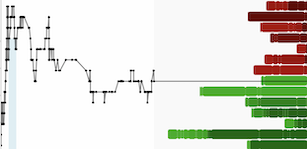

The market reaction to HSBC's gold token launch has been closely monitored by industry analysts and investors alike. While it is still early to gauge the full impact, early indicators suggest a favorable reception, with growing demand for the gold token among retail investors seeking exposure to the precious metal market.

Challenges and Risks

Despite the promising prospects, HSBC's gold token initiative is not without challenges and risks. Technical complexities, regulatory uncertainties, and cybersecurity threats pose significant hurdles that must be addressed to ensure the long-term success and viability of the tokenized asset ecosystem. However, HSBC's robust infrastructure and commitment to risk management mitigate these risks to a considerable extent.

In conclusion, HSBC's gold token launch represents a bold step towards democratizing access to gold investments for retail investors in Hong Kong. By harnessing the power of blockchain technology and forging strategic partnerships, HSBC has demonstrated its leadership in driving innovation within the financial industry. As the adoption of tokenized assets continues to gain momentum, HSBC's initiative serves as a catalyst for positive change, unlocking new opportunities and reshaping the future of finance.