CanAlaska Uranium (CVV-V) has been exploring in the Athabasca Basin of Saskatchewan, the world’s richest uranium-producing region, since 2004.

In that time it has seen over $85 million spent on its projects, mostly by joint venture partners including Mitsubishi, Korean Uranium Consortium JV, Denison Mines and others.

While an economic discovery has so far been elusive, CanAlaska has excellent targets and a large and strategic land position.

The company is led by Peter Dasler, a 63-year-old geologist and mining entrepreneur, and V.P. of Exploration Dr. Karl Schimann, who spent a decade managing exploration in the Basin for French nuclear giant Areva. Dr. Schimann was part of the team that found the rich Cigar Lake deposit in 1988, now in production.

This morning, CanAlaska announced that it is buying back MC Resources Ltd. (Mitsubishi)’s 50% interest in the West McArthur project for $600,000 and a 1% royalty to MC. No word on why Mitsubishi is leaving, and CanAlaska says it is in discussions with other interested parties about the project.

West McArthur has seen over $17 million of exploration work including airborne surveys, ground-based geophysics, and drilling. A few of the holes drilled in 2012 encountered large alteration zones similar to other uranium discoveries in the area, and hasn’t been adequately followed up on since the nuclear accident at Fukushima. West McArthur is adjacent to Cameco’s massive McArthur River mine, infrastructure and Read Lake discovery. Read Lake is not talked about a lot by Cameco, but they have been continuously drilling it since 2008. Cameco has spent over $20 million on the discovery since 2012, according to company filings. Cameco has drilled as close as 500 metres from CanAlaska’s property boundary. The 35,830 ha (88,536 acres) West McArthur project is one of the largest in the Athabasca Basin.

CanAlaska has a few other cool projects. Chuck Fipke and Chad Ulansky’s Northern Uranium (UNO-V) is spending $11.6 million to earn an 80% interest in the NW Manitoba Project. NW Manitoba has a legitimate shot at discovery with high-grade uranium boulders at surface, and excellent water in radon results, backed by a proven mine finder. In addition to retaining its project interest, CanAlaska owns roughly 10% of UNO’s shares.

Korean Uranium Consortium JV spent $19 million for a 50% interest in the Cree East project.

There’s another project partnered with Denison, royalties, and other early-stage projects in CanAlaska’s portfolio.

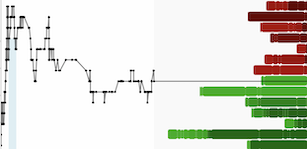

The company has 22.068 million shares outstanding and last traded at 11 cents for an approx. $2.4 million market cap. CanAlaska had $1.2 million in cash at October 31, 2015.

Read: CanAlaska and MC Resources Canada Ltd. agree on West McArthur Uranium Project buyout